The due date for your taxes depends on a few factors, including:

- Individual vs. Business Taxes: Individual income tax deadlines differ from business tax deadlines.

- Federal vs. State Taxes: The IRS sets Federal tax deadlines, while state deadlines vary.

Tax season can be a whirlwind of forms, deadlines, and calculations. Navigating these complexities can be daunting., But understanding key filing dates and seeking professional guidance from Syed Professional Services can empower you to approach tax season confidently.

When are federal taxes due:

- Individual Income Taxes: The deadline to file your federal income tax return for 2023 is typically April 16, 2024 (Tuesday). However, residents of Maine and Massachusetts get an extension due to a state holiday, pushing their deadline to April 18, 2024 (Thursday).

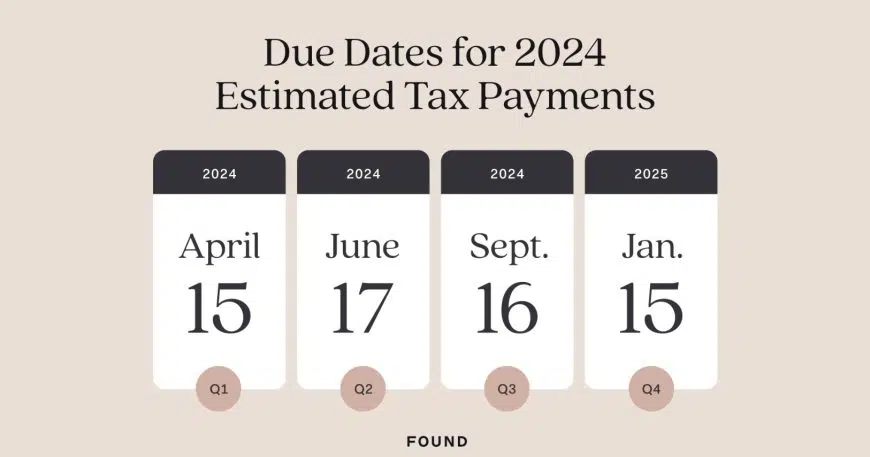

- Quarterly Taxes: If you’re self-employed or have unpredictable income throughout the year, you might be required to make quarterly estimated tax payments. These are typically due on April 18, June 15, September 15, and January 15 of the following year.

Understanding Business Tax Deadlines (2023):

- C Corporations: Generally, corporate tax returns for 2023 are due on the 15th day of the fifth month following the corporation’s tax year-end.

- S Corporations and Partnerships: The deadline to file for S corporations and partnerships for 2023 is typically March 15, 2024. However, the business operates on a fiscal year that deviates from the calendar year. In that case, the deadline falls on the 15th day of the third month after the fiscal year ends. An extension can be requested using Form 7004, extending the deadline to September 15 (or five months after the original deadline).

When are 1099 taxes due 2022

- The deadline to file your tax return for income reported on a 1099 form for tax year 2022 (which you’ll file in 2023) aligns with the federal deadline: April 16, 2024 (or April 18 for Maine and Massachusetts).

When are taxes due 2023 California

California generally follows the same federal tax deadlines. However, it’s always advisable to visit the California Franchise Tax Board website for any specific state filing requirements: https://www.ftb.ca.gov/

Syed Professional Services: Your Partner in Tax Success

While this guide provides a general framework, tax situations can be nuanced. Syed Professional Services can be your invaluable partner in navigating the complexities of tax season:

- Deadline Awareness: They ensure you know all relevant tax deadlines based on your filing status and business structure.

- Accurate and Timely Filings: Syed Professional Services can assist you in filing your tax returns accurately and on time. Minimizing the risk of errors and potential penalties from the IRS.

- Maximizing Tax Benefits: Their tax professionals have the expertise to identify all applicable deductions and credits you can claim, potentially reducing your tax liability.

- Business Tax Expertise: Whether you operate a C corporation, S corporation, or partnership. Syed Professional Services can navigate the intricacies of business tax filing, ensuring your business meets all filing requirements.

- Peace of Mind: Knowing your taxes are handled by a team of qualified professionals allows you to focus on running your business or managing your finances confidently.

Remember

consulting with Syed Professional Services is a wise decision to ensure you meet all tax filing requirements and deadlines. They can guide you through the process, answer your questions, and help you navigate the ever-changing tax landscape. With their expertise, you can approach tax season with control and confidence.