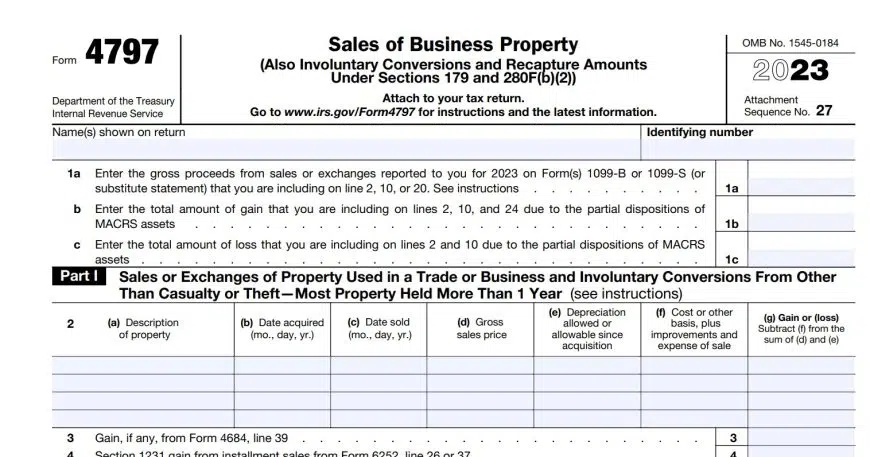

What is Form 4797 (IRS Form 4797)?

Form 4797, officially called Sales of Business Property, is an Internal Revenue Service (IRS) document used to report the gain or loss from the sale or exchange of business property, including:

- Property used in your trade or business (e.g., equipment, machinery)

- Investment property held for more than one year (e.g., rental property)

- Involuntary conversions of property (e.g., due to casualty or condemnation)

What Assets Does Form 4797 Apply To?

This form applies to the sale or exchange of:

- Property used in your trade or business: This includes tangible assets like equipment, machinery, furniture, and vehicles used for business purposes.

- Investment property held for more than one year encompasses assets like rental properties you’ve owned for over a year.

- Involuntary conversions of property: This covers situations where your property is involuntarily converted due to events like fire, theft, condemnation, or casualty.

Who Needs to File Form 4797?

You generally need to file Form 4797 if you sell or exchange business property and have a gain or loss to report on your tax return. It applies to:

- Sole proprietors

- Partnerships

- S corporations

- C corporations

What Information Do I Need for Form 4797?

To accurately complete this Form , you’ll need information such as:

- Description of the property

- Date of purchase and sale

- Purchase cost and selling price

- Depreciation claimed (if applicable)

- Any relevant expenses associated with the sale

How to Fill Out Form 4797:

Discover the official this Form and its instructions on the IRS site at https://www.irs.gov/pub/irs-pdf/f4797.pdf. While the form may be complex, filing it correctly can ensure you precisely document your gains and losses and reduce your tax liabilities.

Syed Professional Services and Form 4797:

Syed Professional Services understands the intricacies of Form and can assist you in several ways:

- Reviewing Your Situation: They can help determine if you must file this Form based on your business transactions.

- Gathering Information: Syed Professional Services can guide you in gathering the necessary information to complete the form accurately.

- Completing the Form: Their tax professionals can assist you in filling out the Form, ensuring all sections are completed correctly and that you benefit from all applicable deductions and credits.

- Tax Planning Strategies: They can help you develop strategies to minimize your tax burden on selling business property.

Benefits of Working with Syed Professional Services:

- Accuracy and Efficiency: Professional help minimizes errors and ensures your form is filed correctly, saving you time and potential penalties from the IRS.

- Maximized Tax Benefits: Their expertise can help you claim all allowable deductions and credits for selling business property.

- Peace of Mind: Knowing your Form is handled by a professional lets you focus on confidently running your business.

Conclusion:

Form 4797 plays a crucial role in reporting the sale of business property and its associated gains or losses. By understanding the form’s purpose and seeking guidance from Syed Professional Services, you can ensure accurate filing and potentially minimize your tax liability.