Introduction:

State income tax is a crucial component of the United States taxation system, playing a significant role in funding various state-level programs and services. This article will delve into what state income taxes entail, their importance, and how Syed Professional Service can assist individuals in navigating the complexities of this tax.

Section 1:

What is State Income taxes?

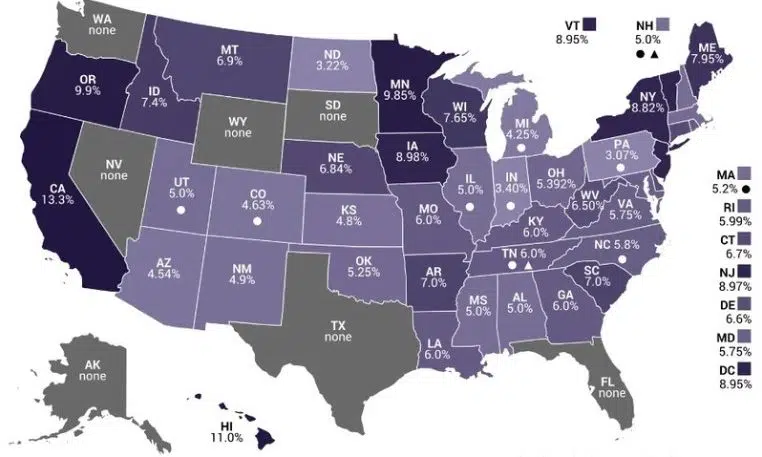

State governments in the United States levied state income taxes on the income of individuals and businesses. While the federal government imposes a federal income tax, each state can determine its income tax policies. As a result, state income taxs rates, deductions, and regulations can vary widely from one state to another.

Typically, it encompasses various types of income, including wages, salaries, dividends, interest, and business profits. The rates are often progressive, meaning that higher-income individuals pay a higher percentage of their tax earnings.

Section 2:

Importance of State Income Tax:

Funding state programs:

State income taxes is a primary source of revenue for state governments. The funds collected through this tax finance essential services such as education, healthcare, transportation infrastructure, and public safety.

Budgetary Flexibility:

States rely on income tax revenue to balance their budgets and address economic fluctuations. A stable and predictable income tax system allows states to adapt to changing financial conditions and maintain fiscal responsibility.

Varied Tax Policies:

The diversity in state income taxes policies allows states to tailor their tax systems to meet their residents’ needs and priorities. Some conditions may choose to have no income tax, while others may implement progressive or flat tax structures.

Section 3:

Navigating State Income Tax with Syed Professional Service:

Syed Professional Service is dedicated to helping individuals navigate the complexities of state income taxs with expertise and efficiency. Here’s how Syed Professional Service can assist you:

Tax Planning:

Syed Professional Service offers strategic tax planning services to help individuals minimize their state income tax liabilities. Crafting a tax-smart plan necessitates an examination of revenue sources, expenses, and potential tax breaks.

Compliance Assistance:

Staying compliant with ever-changing state income taxs laws can take time and effort. Syed Professional Service informs clients about updates, ensures accurate filing, and helps them meet all deadlines to avoid penalties.

Deduction Optimization:

Syed Professional Service explores available deductions to optimize tax outcomes. Reducing the overall tax liability is possible by analyzing potential meritable credits, exemptions, and convictions.

Representation in Audits:

In the event of a state income taxes audit, Syed Professional Service provides representation, ensuring that clients’ rights are protected and helping them navigate the audit process effectively.

Conclusion:

State income taxes are crucial to the U.S. tax landscape, influencing individual and business financial planning. Syed Professional Service is a reliable partner, offering expertise and personalized assistance to individuals seeking to understand, plan for, and navigate the complexities. Whether it’s tax planning, compliance, or audit representation, Syed Professional Service is committed to providing comprehensive and tailored solutions for its clients’ unique needs.