The intricate realm of international business demands meticulous record-keeping and compliance with various regulations. For US persons with ownership or financial ties to foreign corporations, Form 5471 is crucial in fulfilling reporting obligations to the IRS. This post guides you in understanding how Syed Professional Consultants can expertly assist you in navigating its complexities.

What is Form 5471?

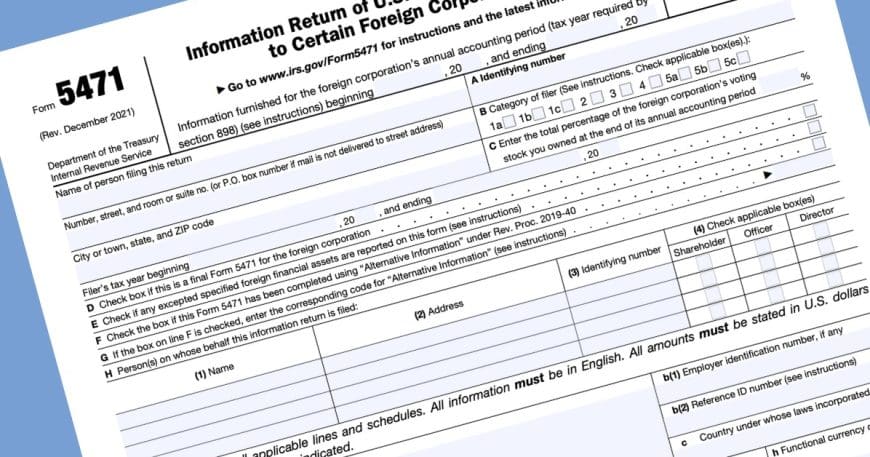

Form 5471, officially titled “Information Return of U.S. Persons Concerning Certain Foreign Corporations,” is a tax form filed by US citizens or residents, partnerships, trusts, and estates. It reports information about certain foreign corporations in which they have ownership or financial interests. It paints a clear picture of a US person’s involvement in foreign entities for tax purposes.

Who Needs to File Form 5471?

The filing requirements for Form 5471 are specific and apply to US persons:

- Owning at least 10% of the voting stock of a foreign corporation at any time during the corporation’s tax year.

- Specific control or financial interests in a foreign corporation, such as receiving distributions from it.

- Being an officer, director, or shareholder of a Controlled Foreign Corporation (CFC).

Critical Information Reported on Form 5471.:

Several crucial details about the foreign corporation and the US person’s involvement are reported , including:

- Identifying information about the foreign corporation and its US owner(s).

- Financial information like income, expenses, and distributions.

- Transactions between the US person and the foreign corporation.

- Ownership and control structure of the foreign corporation.

Essential Things to Know:

- Deadlines: Filing deadlines for Form 5471 vary depending on the specific situation. Consulting a tax professional is crucial to ensure timely and accurate filing.

- Penalties: Failing to file Form 5471 or filing inaccurate information can result in significant fines.

- Complexity: Navigating and its accompanying schedules can be daunting. Seeking professional guidance is highly recommended.

How Syed Professional Consultants Can Help:

Syed Professional Consultants possesses the expertise and experience to ensure your Form 5471 is completed accurately and filed timely. Here’s how they can assist you:

- Determining filing requirements: They assess your situation and accurately decide whether or not you need to file it.

- Gathering and organizing information: They help you gather the necessary information from the foreign corporation and your records.

- Completing the form accurately: Their tax professionals meticulously complete the form and its schedules, ensuring all information is correct and compliant.

- Staying updated on regulations: They remain current with ever-evolving tax laws and filing requirements.

- Communication and representation: They keep you informed throughout the process and represent you if needed in case of IRS inquiries.

Benefits of Partnering with Syed Professional Consultants:

- Peace of mind: Knowing your Form 5471 is handled by experts allows you to focus on your business activities.

- Reduced risk of penalties: Their expertise minimizes the risk of errors and potential penalties.

- Time savings: You avoid the time-consuming process of deciphering complex regulations and completing the form yourself.

- Professional representation: They represent you professionally if the IRS raises questions about your filing.

Navigating Complexities with Confidence:

Form 5471 is crucial in ensuring compliance with international tax regulations. Syed Professional Consultants understands the complexities involved and offers their expertise to guide you through the process seamlessly. Their dedication to accuracy, efficiency, and personalized service empowers you to navigate this essential tax obligation confidently.

Contact Syed Professional Consultants today:

Keep the intricacies of Form 5471 from hindering your international business endeavors. Contact Syed Professional Consultants for a free consultation and discover how their expertise can ensure your compliance and peace of mind.

Remember, accurate and timely filing of Form 5471 is essential for US persons involved in foreign corporations. With Syed Professional Consultants by your side, you can confidently navigate this critical tax obligation and focus on growing your business successfully.