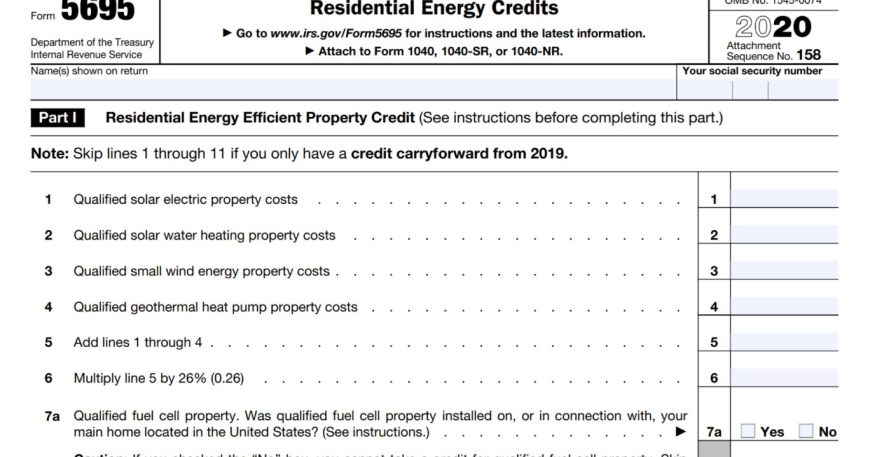

Form5695, officially called the Residential Energy Credits, do homeowners to use an Internal Revenue Service (IRS) document to claim tax credits for qualified energy-efficient home improvements or installing solar energy systems.

Who Needs to Use Form 5695?

Homeowners who have made certain eligible upgrades to their main property usually employ. This form to apply for tax credits related to those improvements.

- Nonbusiness Energy Property Credit (through 2022): This credit allows you to deduct a percentage of the costs associated with certain energy-efficient upgrades to your home, such as new windows, doors, insulation, or water heaters. However, this credit expired for installations or improvements completed after December 31, 2022.

- Residential Energy Efficient Property Credit (for 2023 and onwards): This credit offers a tax credit for some of the costs of specific energy-efficient home improvements, including insulation, new windows and doors, and energy-efficient heating and air conditioning systems.

What Information Do I Need to File Form 5695?

To accurately complete Form5695, you’ll need to gather information such as:

- Your personal information. Name, Social Security number, and mailing address.

- Details of your home: Identify the location where the enhancements took place.

- Information about the improvements: Description of the energy-efficient upgrades, installation date, and total cost.

- Tax credit details: Specify which credit you’re claiming (Nonbusiness Energy Property Credit or Residential Energy Efficient Property Credit) and calculate the amount you’re eligible for based on IRS guidelines.

How to Find and Use Form 5695:

- You can download the latest version of Form5695 and its instructions directly from the IRS website: https://www.irs.gov/forms-pubs/about-form-5695.

- Although filling out this form may prove difficult, obtaining accurate details guarantees you receive all the credits you are due and enjoy maximum tax benefits.

Additional Considerations:

- Expiration of Nonbusiness Energy Property Credit: Remember, the Nonbusiness Energy Property Credit is no longer available for installations or improvements completed after December 31, 2022.

- Consult a Tax Professional: For complex situations or need clarification on your eligibility, consider consulting a tax professional for guidance on completing Form 5695. And maximizing your tax benefits on energy-efficient home improvements.

By understanding Form 5695 and the available residential energy credits. You can reduce your tax burden and encourage energy-saving improvements in your home.

Form 5695 Instructions and How Syed Professional Services Can Help

Understanding Form 5695 and its instructions can be overwhelming. This guide simplifies the process and highlights how Syed Professional Services can help you maximize your residential energy credit benefits.

Where to Find Form 5695 Instructions:

The IRS website offers the official Form5695 and detailed instructions: https://www.irs.gov/forms-pubs/about-form-5695.

These instructions provide a step-by-step guide on completing the form accurately. Here’s a simplified breakdown of the key points:

- Gather Information: Collect details about your qualifying improvements, including descriptions, installation dates, and total costs.

- Determine Credit Eligibility: The instructions will help determine if the improvements qualify for the Nonbusiness Energy Property Credit (which expired for installations/improvements after December 31, 2022) or the Residential Energy Efficient Property Credit (available from 2023 onwards).

- Calculate Your Credit: These instructions guide you through calculating the amount of credit you’re eligible for based on IRS guidelines and the specific credit you claim.

- Complete the Form: Use the gathered information and instructions to fill out the relevant sections of Form 5695.

Challenges of Completing Form 5695:

Despite the existence of guidelines for its completion. This Form can pose difficulties for individuals due to various factors.

- Tax Law Complexity: Tax laws and credit eligibility can be intricate, and staying updated requires constant vigilance.

- Form Complexity: The form itself can be complex. With sections that might need to be more readily understandable to someone unfamiliar with tax terminology.

- Credit Calculations: Accurately calculating the credit amount you’re eligible for can involve specific formulas and considerations.

How Syed Professional Services Can Help:

the complexities of Form 5695 and can assist you in several ways:

- Eligibility Verification: They can help determine if your home improvements qualify for the available residential energy credits.

- Form Completion Assistance: We provide tax professionals to assist you with form completion. Guaranteeing precision throughout the sections while ensuring you get the highest credit you’re eligible for.

- Credit Calculation Expertise: Syed Professional Services can calculate your credit amount correctly based on your specific situation and applicable tax laws.

- Staying Updated on Tax Laws: They stay current on tax law changes and credit updates, guaranteeing you benefit from the latest available incentives.

Benefits of Working with Syed Professional Services:

- Peace of Mind: Knowing your Form5695 is handled by professionals allows you to focus on enjoying the energy-efficiency benefits of your home improvements.

- Maximized Tax Benefits: Their expertise ensures you claim the total amount of credit you’re entitled to. Potentially leading to significant tax savings.

- Accuracy and Efficiency: Acquiring the assistance of experts can significantly reduce mistakes and guarantee . The accurate completion of your documents to the IRS, sparing you from facing consequences and saving valuable time.

Conclusion:

Form5695 is crucial for claiming residential energy credits for qualified home improvements. Understanding the form’s purpose and partnering with Syed Professional Services can ensure a smooth and efficient process, maximize your tax benefits, and contribute to a more energy-efficient home.