Tax season can be a whirlwind of forms and calculations. One form that can trip up even the most organized taxpayer is Form 8960, the Net Investment Income Tax (NIIT) form. This informative guide by Syed Professional Services clarifies the purpose of Form 8960, its filing requirements, and how our team can assist you in navigating this aspect of your tax return.

Understanding Form 8960: Calculating the Net Investment Income Tax

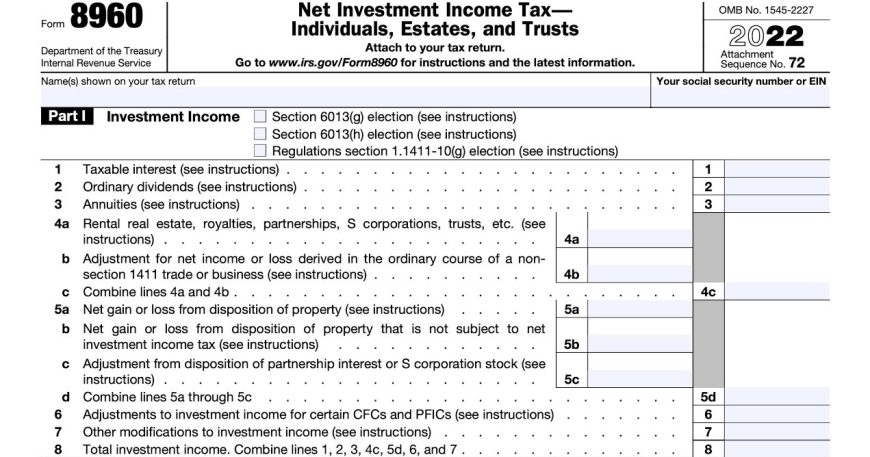

Form 8960, officially titled “Net Investment Income Tax—Individuals, Estates, and Trusts,” calculates the amount of Net Investment Income Tax you may owe. The NIIT is a 3.8% surtax imposed by the Affordable Care Act on certain investment income earned by higher-income taxpayers.

Who Needs to File Form 8960? Understanding the Filing Requirements

Only some people need to file Form 8960. Here’s a breakdown of the filing requirements:

- Modified Adjusted Gross Income (MAGI) Thresholds: You only need to file this Form if your Modified Adjusted Gross Income (MAGI) exceeds specific thresholds. These thresholds are adjusted annually, but for 2023 they were:

- $200,000 for single filers and married filing separately.

- $250,000 for married filing jointly.

- Net Investment Income: Even if your MAGI exceeds the thresholds, you only owe NIIT if your net investment income exceeds zero.This Form helps determine this by calculating your income and subtracting certain related expenses.

Investment Income and Expenses: What Counts for Form 8960?

Here’s a closer look at the types of income and expenses considered on Form 8960:

- Investment Income: This includes interest, dividends, capital gains (profits from selling investments), rental income, and royalties.

- Investment Expenses: You can deduct certain expenses to offset your income, reducing your net investment income and potential NIIT liability. Examples include investment management fees, safe deposit box rentals related to investments, and interest paid on investment loans.

Understanding Form 8960: Key Sections and Information Required

While Form 8960 might seem complex, it’s relatively straightforward once you understand its components. Here’s a breakdown of some key sections:

- Part I: Taxpayer Information: Fill in your basic contact and tax return details for the year.

- Part II: Investment Income: List all your various sources of investment income throughout the tax year.

- Part III: Investment Expenses: Deduct allowable investment expenses to determine your net income.

- Part IV: Net Investment Income Tax: This section calculates the amount of NIIT you may owe based on your net investment income and MAGI.

Syed Professional Services: Your Trusted Partner for Form 8960

This Form and the intricacies of NIIT calculations can be daunting. Syed Professional Services can be your guide through this process, offering:

- NIIT Applicability Assessment: We can help determine whether you must file this Form based on your MAGI and overall income picture.

- Accurate Form Completion: Our tax professionals can assist you in completing this Form , ensuring all sections are filled out accurately and that you take advantage of all allowable investment expense deductions.

- Tax Optimization Strategies: We can explore strategies to minimize your NIIT liability while staying compliant with IRS regulations.

- Peace of Mind During Tax Season: By partnering with us, you can confidently navigate this Form and NIIT calculations, reducing tax-related stress.

Conclusion: Understanding Form 8960 for a Smooth Tax Season

Understanding Form 8960 and the NIIT can help you approach. Tax season with a clearer picture of your potential tax obligations. By familiarizing yourself with the key points and seeking guidance from Syed Professional Services. You can ensure accurate this Form filing and navigate the NIIT aspects of your tax return efficiently. Remember, we are here to help you understand the complexities of tax regulations and ensure you accurately fulfill your tax filing requirements.