The world of S corporations offers tax advantages for small businesses. However, navigating the intricacies of tax regulations can be challenging for S corporation shareholders. One crucial form in this process is Form 7203, and understanding its purpose is essential. This comprehensive guide by Syed Professional Services sheds light on Form 7203, its filing requirements, how to fill it out accurately. And how our team can assist you in tackling this aspect of your S corporation involvement.

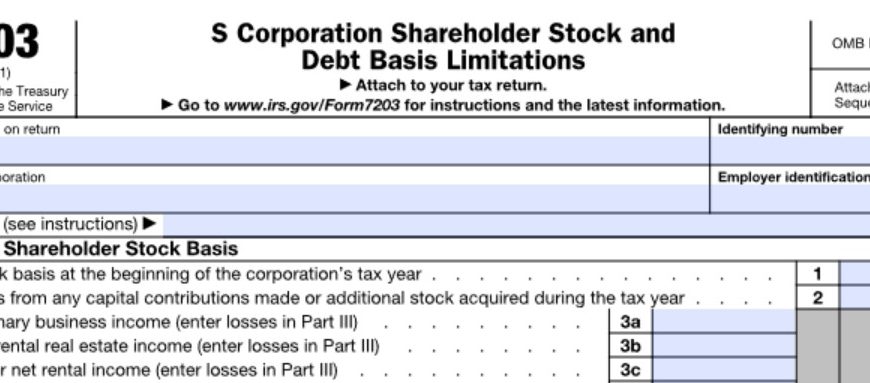

Understanding Form 7203: Keeping Track of Shareholder Basis

Form 7203, titled “Shareholder’s Stock and Debt Basis,” is vital in calculating potential limitations on an S corporation shareholder’s deductions for losses. Credits, and other tax benefits passed through from the corporation. In simpler terms, it helps ensure that the deductions a shareholder claims don’t exceed their investment in the S corporation (stock basis and any loans made to the corporation).

Who Needs to File Form 7203? Understanding the Filing Requirements

Not all S corporation shareholders need to file Form 7203. Here’s a breakdown of the situations that trigger a filing requirement:

- Claiming Deductions for S Corporation Losses: If you, as a shareholder, are claiming a deduction for your share of any losses from the S corporation. Including past losses disallowed due to basis limitations, you generally need to file this Form .

- Receiving Non-Dividend Distributions: If you receive a non-dividend distribution from the S corporation (a distribution that isn’t a return on your investment). You might need to file this Form .

- Disposing of S Corporation Stock: Whether you sell your S corporation stock at a gain or loss. Filing Form 7203 might be necessary to determine your reportable gain or loss for tax purposes.

- Receiving Loan Repayments: If the S corporation repays a loan you made to it. This Form might be required depending on the nature of the loan and repayment terms.

When in Doubt, Consult a Tax Professional: Due to the complexities of S corporation taxation, consulting with a tax professional like Syed Professional Services is advisable to determine whether you need to file Form 7203 in your specific situation.

Understanding Form 7203: Key Sections and Information Required

While Form 7203 might appear complex, understanding its components can make the process smoother. Here’s a breakdown of some key sections:

- Stock Basis Information: This section tracks your investment in the S corporation, including the original purchase price of your stock. Any additional contributions, and distributions received.

- Debt Basis Information: If you’ve loaned money to the S corporation. This section tracks the amount and basis of the loan.

- Loss Information: If claiming a deduction for S corporation losses. You’ll report the amount of loss and any potential basis limitations calculated based on your stock and debt basis.

- Non-Dividend Distributions: Report the amount and nature of any non-dividend distributions received from the S corporation during the tax year.

- Sales and Dispositions of Stock: If you sold or disposed of your S corporation stock, report the details of the transaction and any calculated gain or loss.

Syed Professional Services: Your Trusted Partner for Form 7203

Proper completion of Form 7203 necessitates comprehension of the taxation guidelines for S corporations and knowledge of your specific shareholder basis. Syed Professional Services can be your guide through this process, offering:

- Filing Requirement Assessment: We can analyze your S corporation involvement and tax situation to determine whether you need to file this form.

- Form Completion Assistance: With the help of our tax experts. This Form can be executed with precision, as they’ll ensure that you’ve completed every segment with the utmost accuracy and that all your core tax calculations are spot on.

- Maximizing Deductions and Benefits: We can help you understand how this form impacts your ability to claim deductions. And benefits from the S corporation while staying compliant with IRS regulations.

- Minimizing Tax Liabilities: By ensuring accurate this Form filing,. We can help you reduce your tax liabilities associated with S corporation distributions and losses.

Conclusion: Navigating Form 7203 with Confidence

Understanding Form 7203 empowers S corporation shareholders to maintain accurate records of their basis and claim their rightful share of deductions and benefits. By familiarizing yourself with the key points and seeking guidance from Syed Professional Services . You can ensure accurate Form 7203 filing and navigate the complexities of S corporation taxation more confidently. Remember