Tax season can be daunting, especially when navigating the complexities of claiming tax credits. If the IRS has disallowed certain refundable credits you previously claimed, IRS Form 8862 becomes your key to reclaiming those credits. This informative guide by Syed Professional Services demystifies Form 8862, explaining its purpose, eligibility requirements, and how our team can assist you in utilizing it effectively.

Understanding Form 8862: Restoring Access to Refundable Tax Credits

IRS Form 8862, titled “Information To Claim Certain Credits After Disallowance,” allows you to reclaim certain refundable tax credits that the IRS previously disallowed. These credits can include:

- Earned Income Tax Credit (EITC): A valuable credit for low- and moderate-income taxpayers.

- Child Tax Credit (CTC) and Additional Child Tax Credit (ACTC): Credits to offset child-rearing expenses.

- Credit for Other Dependents (ODC): A credit for qualifying dependents who are not your children.

- American Opportunity Tax Credit (AOTC): A credit for qualified education expenses.

Why Use Form 8862? When the IRS Disallows Your Credits

The IRS might disallow your claimed credits for various reasons, including:

- Math or Clerical Errors: The IRS might only allow the credits if there are simple miscalculations or typos in your tax return.

- Missing or Incorrect Documentation: Not providing the necessary documentation to support your claim can lead to credit disallowance.

- Ineligibility Issues: If you don’t meet the specific eligibility requirements for a particular credit, the IRS will disallow it.

Eligibility for Using Form 8862: Meeting the Requirements

To utilize Form 8862 effectively, you must meet specific criteria:

- Previous Disallowance: The IRS must have previously disallowed the specific refundable credit you’re trying to reclaim.

- Meeting Eligibility Requirements: You must demonstrably meet the eligibility criteria for the credit you claim.

- Accurate Documentation: Ensure you have the necessary documentation to support your claim, such as proof of income, child dependency documents, or education expense receipts (depending on the credit you’re reclaiming).

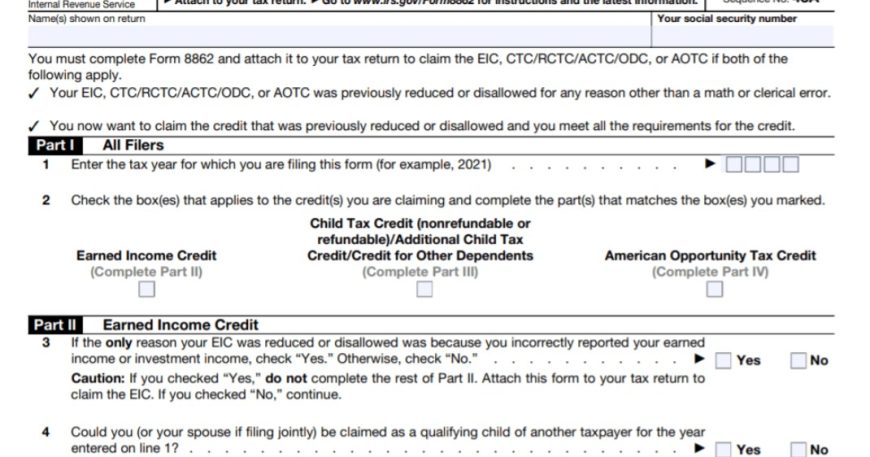

Completing Form 8862: Understanding Key Sections

Form 8862 is relatively straightforward, but here’s a breakdown of some key sections:

- Part I: Taxpayer Information: Fill in your basic contact information and tax return details for the year.

- Part II: Specific Credit(s) Claimed: Indicate the specific credit(s) you’re attempting to reclaim using Form 8862.

- Part III: Explanation for Disallowance: Briefly explain why you believe the IRS disallowed your credit claim. Be factual and concise.

- Part IV: Documentation: List the documentation you’re attaching to support your claim for the credit(s).

- Part V: Qualifying Child Information (for CTC/ACTC/ODC): If you’re reclaiming the CTC, ACTC, or ODC, provide details about your qualifying child(ren).

Syed Professional Services: Your Trusted Partner in Navigating Form 8862

While Form 8862 can be a valuable tool, navigating the intricacies of tax law and credit eligibility can be complex. Syed Professional Services can provide expert assistance with Form 8862, including:

- Reviewing Your Tax Situation: We can analyze your tax return and identify any potential discrepancies that led to credit disallowance.

- Determining Eligibility: We can help determine if you meet the requirements to reclaim specific credits using this Form .

- Completing the Form Accurately: Our tax professionals can guide you through this Form , ensuring all sections are completed accurately and effectively.

- Gathering Supporting Documentation: We can advise you on the necessary documentation to support your credit claim and assist you in collecting it.

Beyond Form 8862: Avoiding Credit Disallowance in the Future

Here are some tips to minimize the risk of credit disallowance in the future:

- Consult a Tax Professional: Seek guidance from a tax professional like Syed Professional Services when claiming refundable credits to ensure you meet all eligibility requirements and documentation needs.

- Maintain Accurate Records: Keep meticulous records of your income, expenses, and other relevant documentation to support your tax return claims.

- File Electronically: Filing electronically can minimize errors and expedite the processing of your tax return.

- Respond Promptly to IRS Notices: If you receive an IRS.