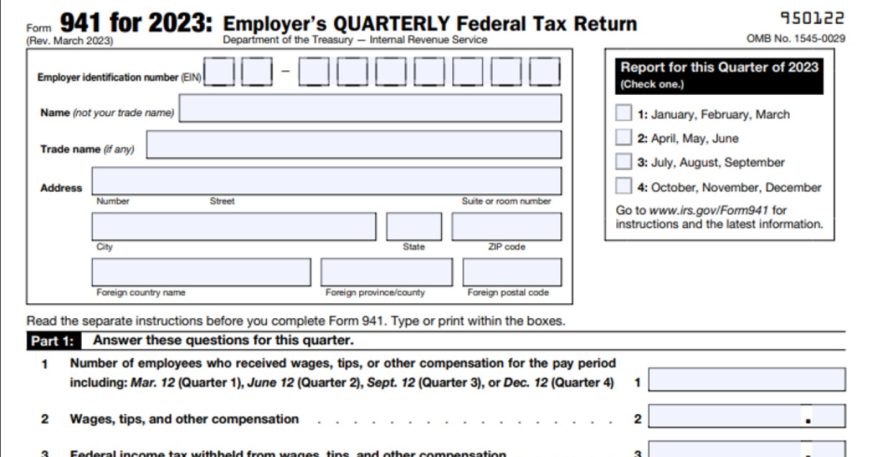

For Tax Year 941 Form 2023 (filed in 2024):

- You would have used Form 941 (Rev. March 2023) to report federal income taxes withheld from employees and the employer’s share of Social Security and Medicare taxes for all four quarters of the tax year 2023.

- The filing deadline for Form 941 (Rev. March 2023) has already passed. The deadlines are typically the last day of the month following the end of the quarter.

The tax form known as 941 must be filled out for 2024 and submitted in 2025.

- For tax year 2024 (which you’ll file in 2025), you’ll use the most recent revision of Form 941, likely Form 941 (Rev. December 2024) (assuming a revision is issued in December 2024). This form will reflect any tax law or reporting changes for 2024.

- The specific deadlines for Form 941 (Rev. December 2024) will be available closer to the filing due dates. They are typically the last day of the month following the end of the quarter.

Critical Changes for Form 941 (as of March 2024):

- Previously, lines were provided to report for qualified sick and family leave wages exclusive to the 2020 and 2021 tax years. Yet, because the opportunity for claiming credit for such has come and gone, the latest modification of the revenue code (Rev. March 2024) has omitted said lines. Despite that, those who had paid for contributions related to that matter can still seek credit via submission of Form 8974.

- Forms 941-SS and 941-PR Discontinued: These forms, used by employers in U.S. territories, are no longer required. Employers in U.S. territories can now file Form 941 or the new Spanish version, Form 941 (sp).

What is Form 941 Schedule B?

Form 941 Schedule B, also known as the Report of Tax Liability for Semiweekly Schedule Depositors, is an attachment to Form 941 used by specific employers to report their federal payroll tax liability daily for each quarter of the tax year.

Who Needs to File Form 941 Schedule B (2023)?

Not every employer is bound to submit Schedule B; exclusively obligatory for specific decorators’ areas:

- Suppose the total employment taxes you reported on your Form 941 during the last four quarters surpassed $50,000. In that case, Schedule B will be necessary for the forthcoming year. On the other hand, if at any point during the present or previous financial year, your cumulative tax liability went beyond $100,000, filing Schedule B will become a compulsory requirement.

What Information Goes on Schedule B (2023)?

If you qualify as a semiweekly depositor and must file Schedule B for tax year 2023 (filed in 2024), you would have used Schedule B (Rev. March 2023). This version included these key elements:

- You were required to record each day that wages were received during the quarter. The federal income tax withheld from employees and the employer’s portion of Social Security and Medicare taxes. The total daily tax responsibilities are added together each quarter to calculate the comprehensive tax payment needed to file Form 941.

Critical Updates in Schedule B (Rev. March 2023):

- Some fresh info about Schedule B: update enhanced the most money a certified. Little enterprise can claim as a tax credit for payroll-linked research spending. The enterprise, if eligible, can leverage the credit to shrink payroll taxes caused by contributing to social welfare. Dropping the ultimate sum on accrued payroll taxes as regards medical welfare responsibilities.

Since the filing deadline for Form 941 and Schedule B (Rev. March 2023) has passed, you won’t be using this specific version anymore. However, understanding its purpose can help you prepare for filing in the future.

Resources for Future Filings:

- The IRS website will have the most recent version of Schedule B available closer to the filing deadlines for tax year 2024 (filed in 2025). You can expect a revision titled Schedule B (Rev. December 2024) (assuming a revision is issued in December 2024).

- Instructions for the most recent version of Schedule B will also be available on the IRS website.

Remember:

- It’s always advisable to consult with a tax professional or refer to the latest IRS instructions for Form 941 and Schedule B . When filing your taxes, especially if you need clarification on your filing requirements.

Role of Syed Professional Services in Form 941 (2023) and Schedule B (2023):

Even though the filing deadlines have passed, Syed Professional Services can be a valuable asset for future filings:

- Understanding Filing Requirements: They can help you determine if you qualify as a semiweekly depositor and, therefore, must file Schedule B in the coming year.

- When you enlist Syed Professional Services For assistance with your tax requirements. Their thorough completion of Form 941 can help you dodge potential errors and fines petitioned by the IRS.

- Schedule B Expertise:. They can guide you through the specific requirements of filling out Schedule B if you qualify as a semiweekly depositor.

- Staying Updated on Tax Law Changes: Tax laws and filing requirements can change yearly. Syed Professional Services stays updated on these updates to ensure you’re filing using the latest guidelines.

Conclusion

You understand Form 941 and Schedule B. Along with the valuable services provided by Syed Professional Services can empower you to approach. Future tax filings confidently by partnering with them. You can ensure accurate tax reporting, minimize potential tax liabilities, and stay up-to-date on relevant tax law changes.