A Guide to Form 941 Schedule B with Syed Professional Services

Tax season can be particularly complex for businesses, especially regarding payroll taxes. This informative guide by Syed Professional Services explores Form 941 Schedule B, a crucial form for semi-weekly payroll tax depositors, and explains how it helps streamline your tax filing process. We’ll also highlight how our team of tax professionals can ensure accurate and efficient handling of your payroll tax obligations.

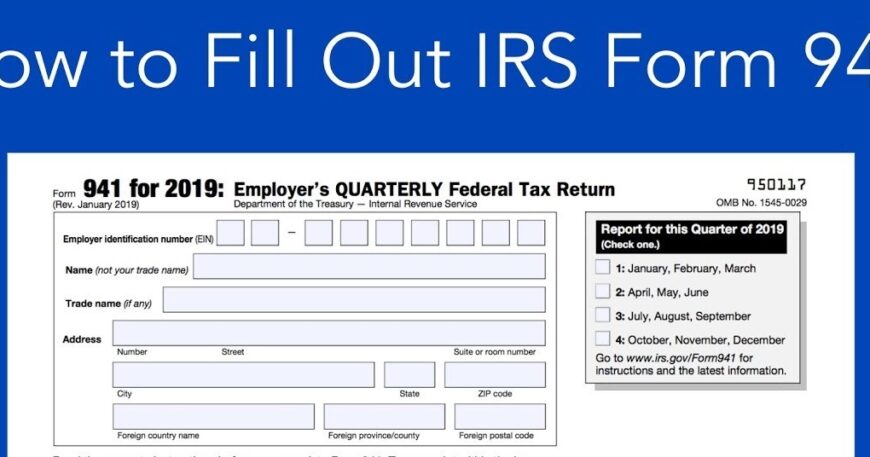

Understanding Payroll Taxes and Form 941

As an employer, you’re responsible for withholding federal income tax, Social Security tax, and Medicare tax from your employee’s wages. The IRS requires business owners to submit the Employer’s Quarterly Federal Tax Return, or Form 941, which collects any withheld employee taxes and the employer’s portion of Social Security and Medicare payments. This must occur every Quarter so that the government receives regular remittances.

Who Needs to Use Form 941 Schedule B?

Not all businesses use Form 941 Schedule B. This schedule is specifically for employers who are considered

pen_spark

semi-weekly depositors for payroll taxes. Here’s how to determine if you fall under this category:

- Tax Liability Threshold:.If, at any point during a quarter, your accumulated tax liability (withheld income taxes and your share of Social Security and Medicare taxes) reaches $100,000 or more, you become a semi-weekly depositor for the remaining tax deposits of that Quarter and all subsequent quarters until your liability falls below this threshold for an entire quarter.

- Lookback Period:. Alternatively, if your undeposited payroll taxes exceeded $50,000 during the previous four quarters, you’ll be considered a semi-weekly depositor for the entire current and subsequent quarters until you fall below the threshold for a whole quarter.

What is Form 941 Schedule B Used For?

Form 941 Schedule B serves a specific purpose for semi-weekly depositors:

- Daily Tax Liability Reporting:. Unlike Form 941, which focuses on quarterly tax deposits, Schedule B requires reporting your federal income tax withheld and your employer’s share of Social Security and Medicare taxes for all paydays within the Quarter.

- Streamlining Deposits:. By reporting your daily tax liability, Schedule B helps you calculate the exact amount you need to deposit semi-weekly, ensuring you remain compliant with IRS regulations.

Understanding Form 941 Schedule B (2024 and Beyond)

The IRS periodically updates Form 941 and its schedules. While this guide focuses on the general functionality of Schedule B, it’s important to note that the specific layout and instructions might change slightly from year to year. Always refer to the IRS website for the latest version of Form 941 Schedule B. Here’s a general breakdown of the information typically found on Schedule B:

- Employer Identification Number (EIN): Enter the employer identification number assigned by the IRS.

- Calendar Year and Quarter: Indicate the calendar year and the specific Quarter (e.g., 1st Quarter) for which you’re reporting.

- Daily Tax Liability Table: This table is the core of Schedule B. It includes numbered spaces for each quarter day where you’ll record the total federal income tax withheld and your employer’s share of Social Security and Medicare taxes for each payroll.

- Tax Liability for Months 1 and 2 (Optional): Some versions of Schedule B may have sections that calculate the total tax liability for each month within the Quarter.

Syed Professional Services: Ensuring Accurate Payroll Tax Filing

Managing payroll taxes and navigating forms like Schedule B can be complex and time-consuming. Syed Professional Services can empower your business with the following:

- Deposit Schedule Determination:. We’ll help determine whether you qualify as a semi-weekly depositor and guide you through switching to Schedule B if necessary.

- Accurate Form Completion:. Our tax professionals can ensure your Schedule B is filled out accurately, reflecting your daily tax liabilities for the entire Quarter.

- Timely Deposits and Filing:. We can help you meet your semi-weekly deposit deadlines and ensure that your Form 941 and Schedule B are filed promptly with the IRS.

- Tax Planning and Optimization:. We can explore strategies to minimize your payroll tax burden and ensure you take advantage of all available tax deductions and credits.

Simplifying Payroll Tax Management for Your Business

Refrain from letting payroll tax complexities bog down your business operations. Syed Professional Services clarifies and ensures you handle your payroll tax obligations efficiently and accurately.

Contact us today to discuss your specific situation.