Tax season can be particularly daunting for businesses, especially regarding payroll taxes. Form 940, the Employer’s Quarterly Federal Tax Return, is crucial. This informative guide by Syed Professional Services dives deep into Form 940, explaining its purpose, who needs to file it, and the information it captures. We’ll also explore filing deadlines and how our team of tax professionals can ensure accurate and efficient handling of your payroll tax obligations.

Understanding Payroll Taxes and Form 940

As an employer, you’re responsible for withholding federal income tax, Social Security tax, and Medicare tax from your employee’s wages. Form 940 serves as the primary mechanism for reporting and depositing these withheld taxes, along with your share of Social Security and Medicare taxes, to the IRS. Filing Form 940 quarterly ensures timely payroll tax remittance and compliance with IRS regulations.

Who Needs to File Form 940?

Most businesses with employees are required to file Form 940. Here’s a breakdown of who typically needs to file:

- Businesses Withholding Payroll Taxes: If you withhold federal income tax, Social Security tax, or Medicare tax from your employee’s wages, you must file Form 940.

- Household Employees: If you have household employees like nannies, housekeepers, or personal assistants, you may need to file Form 940, depending on the wages paid and taxes withheld. Consult with a tax professional for specific guidance on household employee tax filing.

- Agricultural Employers: While most agricultural employers file Form 943 (Employer’s Annual Tax Return for Agricultural Wages), exceptions may exist. Always verify the correct form with the IRS for your specific situation.

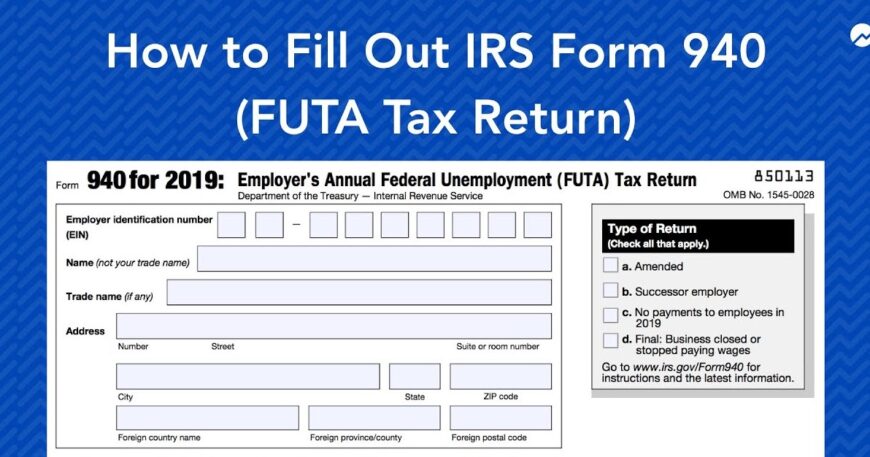

What Information Does Form 940 Capture?

Form 940 gathers essential information about your business and its payroll tax activity for the Quarter:

- Employer Identification Number (EIN): This unique identifier assigned by the IRS is used to identify your business on tax forms.

- Tax Period: Indicate the specific Quarter (e.g., 1st Quarter) for which you’re filing the return.

- Total Wages and Tips Paid: Report the total wages and tips paid to your employees during the Quarter.

- Federal Income Tax Withheld: Enter the total federal income tax withheld from your employee’s wages for the Quarter.

- Social Security and Medicare Taxes: Report the total amount of Social Security and Medicare tax withheld from employee wages and your employer’s share of these quarterly taxes.

- Tax Payments: Indicate the amount of taxes you deposited with the IRS throughout the Quarter. This may involve semi-weekly deposits for businesses exceeding a particular tax liability threshold.

Understanding Form 940 Deadlines and Deposit Requirements

The deadline to file Form 940 typically falls on the last day of the month following the end of the Quarter. However, the deadline is extended to the following business day if the due date falls on a weekend or federal holiday. Here’s a breakdown of filing deadlines based on Quarter:

- 1st Quarter: April 30th

- 2nd Quarter: July 31st

- 3rd Quarter: October 31st

- 4th Quarter: January 31st (of the following year)

Deposit Requirements and Potential Penalties

For most businesses, payroll tax deposits are made electronically throughout the Quarter. The IRS has specific deposit rules based on your tax liability. Suppose your accumulated tax liability for the Quarter reaches $100,000 or more. In that case, you become a semi-weekly depositor for the remaining tax deposits of that Quarter and all subsequent quarters until your liability falls below this threshold for an entire quarter. Failure to make timely deposits can result in penalties and interest charges.

Syed Professional Services: Your Payroll Tax Filing Partner

Ensuring accurate and timely Form 940 filing is crucial for payroll tax compliance. Syed Professional Services can empower your business by:

- Determining Filing Requirements:. We’ll help you decide whether to file Form based on your employee structure and payroll tax withholdings.

- Accurate Form Completion: Our tax professionals can guide you through Form and ensure all information is filled out accurately and completely.

- Deposit Schedule Management: We can help you understand deposit deadlines and ensure timely remittance of payroll taxes throughout the Quarter, potentially avoiding penalties.

- E-filing Guidance: If you choose an electronic