In the intricate world of partnership taxation, Form 8978 (Partner’s Additional Reporting Year Tax) needs to be clarified. This post is your comprehensive guide to understanding Form 8978, its purpose, the potential complexities involved, and how Syed Professional Experts can empower you to navigate it effectively.

What is Form 8978, and When is it Used?

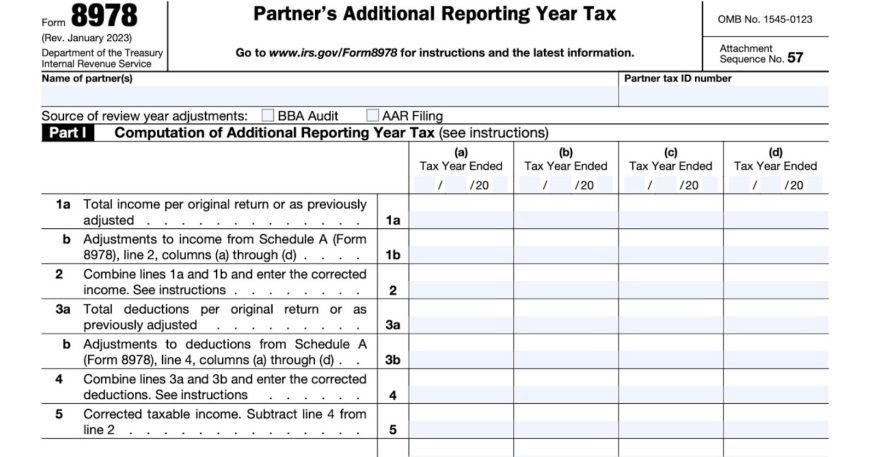

Form 8978 is an IRS document designed explicitly for partners (excluding those in pass-through entities like S corporations or partnerships) who receive a Form 8986 (Partner’s Share of Adjustment(s) to Partnership Related Item(s)) from their collaboration. This form comes into play when a reviewed year adjustment is made to the partnership’s tax return, which ultimately impacts the taxable income reported by individual partners.

Understanding Reviewed Year Adjustments and Their Implications:

Reviewed year adjustments can arise due to various reasons, such as:

- IRS Audits: If the IRS audits the partnership and identifies discrepancies. It can adjust its income or deductions, impacting partner allocations.

- Error Correction: Errors discovered in previously filed partnership tax returns might necessitate adjustments to ensure accurate tax reporting.

- Voluntary Adjustments: In some cases, the partnership might initiate voluntary adjustments to its tax return. Requiring partners to reflect these changes on their tax filings.

The consequence of these reviewed year adjustments is that partners’ taxable income for the affected year (reviewed year) and potentially for intervening years up to the adjustment year must be recalculated. Form 8978 serves as the mechanism for partners to report these adjustments and any resulting tax liabilities on their tax returns.

Importance of Accurate Form 8978 Completion and Potential Challenges:

Form 8978 ensures accurate tax reporting for partners affected by reviewed year adjustments. However, the form itself and the underlying calculations can be complex. Here’s a breakdown of the potential challenges:

- Determining Filing Obligation: Not all partners receiving Form 8986 need to file Form 8978. Understanding the specific criteria for filing based on the adjustments. And their impact on your tax situation can take time and effort.

- Accurate Calculations: Recalculating your tax liability for multiple years based on the adjustments requires meticulous attention to detail and a strong understanding of tax regulations. Even minor calculation errors can lead to significant discrepancies and potential penalties from the IRS.

- Understanding the Form: The structure of Form 8978 might seem overwhelming, with sections dedicated to various adjustments and calculations. Form 8986 can be challenging for taxpayers unfamiliar with its intricacies to reflect the adjustments communicated through the form accurately.

How Syed Professional Experts Can Help You with Form 8978:

Filing Form 8978 accurately and efficiently is crucial to avoid penalties and interest charges associated with errors or late filings. Partnering with Syed Professional Experts offers a multitude of benefits throughout the process:

- Understanding Your Need to File: Our tax professionals can meticulously assess your situation based on the information in your Form 8986. Determine with finality whether you have a legal obligation to file Form 8978.

- Accurate Form Completion and Calculations: We possess the expertise to complete Form 8978 for you meticulously. It includes ensuring all necessary adjustments are reflected accurately. Performing the required tax calculations for affected years, and adhering to all IRS filing regulations.

- Minimizing Penalties and Interest: By ensuring a precise and timely filing of Form . We help reduce the risk of errors and delays that could lead to penalties and interest charges from the IRS.

- Effective Communication and Representation: If any inquiries or potential issues arise from your this Form filing. Our team can effectively communicate with the IRS on your behalf, ensuring a smooth resolution and protecting your interests.

Conclusion:

Form 8978 might seem daunting, but with the proper guidance, you can navigate it effectively and ensure accurate tax reporting for the affected years. Syed Professional Experts stand by your side throughout the process, providing the necessary expertise to handle complex calculations, ensure accurate form completion, and minimize potential tax liabilities. By seeking our professional assistance, you can achieve tax compliance with peace of mind. Allowing you to focus on your business endeavours and financial goals.