Tax season can be complex, especially if you must pay more in estimated yearly taxes. It can result in an underpayment penalty on your tax return. Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts, serves as the official document for reporting and potentially requesting a waiver of this penalty. This comprehensive guide by Syed Professional Service tackles Form 2210, explaining its purpose, critical sections, and how our team can confidently empower you to navigate underpayment situations.

Understanding Estimated Taxes and Form 2210

Estimated taxes are quarterly payments made yearly to prepay your income tax liability. You’re typically responsible for making estimated tax payments if you have income sources not subject to withholding (e.g., self-employment, freelance work, investment income). This Form helps determine if you underpaid your estimated taxes and potentially waive any resulting penalties.

Who Needs to Use Form 2210?

You might need to use Form 2210 if you meet any of the following criteria:

- Underpaid Estimated Taxes: If the total amount of your estimated tax payments and withholding throughout the year falls short of your actual tax liability, you may have underpaid your estimated taxes.

- Qualify for Penalty Waiver: Even if you are underpaid, you might qualify for a waiver of the underpayment penalty if you can demonstrate reasonable cause. Form 2210 allows you to explain your situation to the IRS.

- High-Income Taxpayers: Special rules regarding estimated tax payments apply to taxpayers whose adjusted gross income exceeds a certain threshold (established annually by the IRS). This Form can help navigate these complexities.

Understanding Key Sections of Form 2210

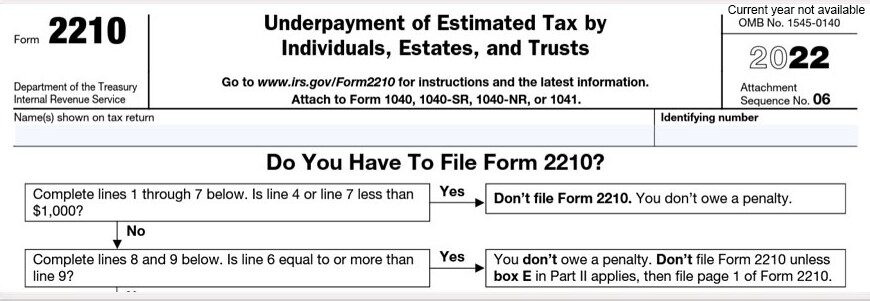

While Form 2210 might appear daunting, understanding its sections simplifies the process. Here’s a breakdown of the critical parts:

- Part I – Taxpayer Information: This section gathers basic information about you, including your name, Social Security number, and filing status.

- Part II – Underpayment of Estimated Tax: Here, you’ll calculate your estimated tax liability based on your prior year’s tax return or your expected income for the current year. You’ll then compare this to your actual tax payments and withholding to determine if you are underpaid.

- Part III – Penalty Calculation (Optional): This section allows you to calculate the potential underpayment penalty based on the shortfall and the quarter(s) in which the underpayment occurred. However, you can skip this section if you’re requesting a penalty waiver.

- Part IV – Explanation of Underpayment (Optional): This crucial section allows you to explain why you underpaid your estimated taxes. A clear and concise justification for the underpayment is essential for requesting a penalty waiver.

Beyond Form 2210: Strategies for Managing Estimated Taxes

While Form 2210 plays a vital role, here are some additional considerations for effectively managing estimated taxes:

- Understanding Estimated Tax Rates: The IRS sets annual tax rates based on your prior year’s tax return. Familiarize yourself with these rates to ensure you make adequate estimated tax payments throughout the year.

- Tax Withholding Adjustments: You can adjust the amount of income tax withheld from your paycheck by submitting a new Form W-4 to your employer. It can help ensure you’re withholding enough to avoid underpayment penalties.

- Staying Organized: Maintain precise records of your income, tax payments, and estimated tax calculations throughout the year. It will be essential for accurate Form 2210 completion and potential penalty waiver requests.

Syed Professional Service: Your Partner in Navigating Underpayments

Facing an underpayment situation and Form 2210 can be stressful. Syed Professional Service can be your trusted partner throughout this process:

- Estimated Tax Planning:. We can help you calculate your estimated tax liability and guide you on making timely and adequate payments throughout the year.

- Form 2210 Completion Expertise:. Our tax professionals can assist you in accurately completing Form 2210. Ensuring all calculations and justifications for penalty waivers are presented effectively.

- Penalty Waiver Strategies:. We can help you assess your eligibility for an underpayment penalty waiver and craft a compelling explanation for the IRS.

- Ongoing Tax Guidance:. Beyond estimated taxes, we offer comprehensive tax services to help you stay organized and compliant with all tax regulations.

Proactive Tax Management for Peace of Mind

By working with Syed