Introduction:

Navigating the complex landscape of taxes is a crucial aspect of financial planning, and understanding the intricacies of Social Security and Medicare taxes, also known as FICA taxes, is paramount. This comprehensive guide will break down what FICA taxes entail, their significance, and how Syed Professional Service can be your guiding light in navigating these crucial components of the U.S. tax system.

Section 1:

What is FICA?

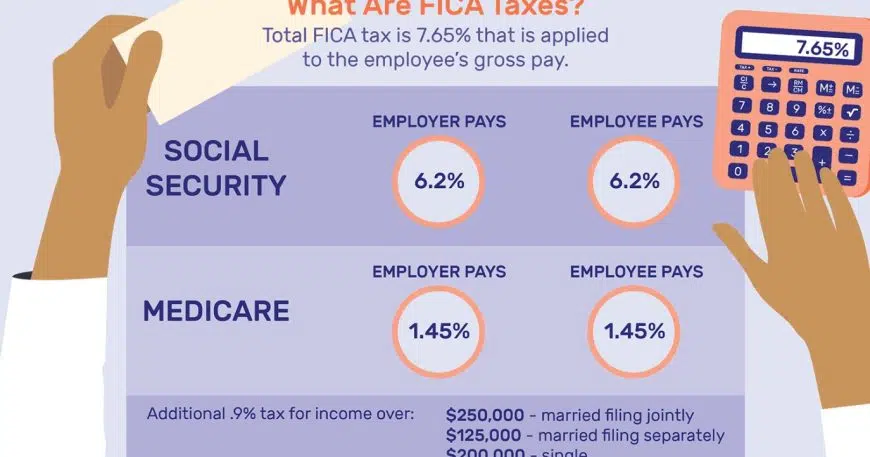

The Federal Insurance Contributions Act (FICA) encompasses two significant components: Social Security and Medicare taxes. These taxes are levied on income to fund the Social Security and Medicare programs, which provide eligible individuals with financial support and healthcare benefits.

- Social Security Tax:

-

- Funding Retirement Benefits: The Social Security Tax primarily finances the Social Security program, offering retirement benefits to eligible individuals based on their work history and contributions.

- Income Thresholds: Employees and employers each contribute a percentage of the employee’s wages up to a specified income threshold. This threshold is subject to annual adjustments.

- Medicare Tax:

-

- Healthcare Funding: Medicare Tax supports the Medicare program, which provides health insurance for individuals aged 65 and older, specifically younger individuals with disabilities.

- Two Tiers of Taxation: Medicare Tax has two components: the standard rate and an additional rate for high-income earners. This different rate applies to wages beyond a certain threshold.

Section 2:

The Significance of FICA Taxes:

- Social Security Benefits:

-

- Retirement Income: Contributions made through Social Security taxes translate into retirement income for individuals, providing a financial safety net during their retirement years.

- Disability Benefits: Social Security also offers disability benefits to those who qualify, providing financial support in the event of a qualifying disability.

- Medicare Health Coverage:

-

- Healthcare Access: Medicare ensures that eligible people can access essential healthcare services, such as hospital stays and preventive care, thanks partly to Medicare taxes.

- Financial Security: Medicare helps protect individuals from potentially extreme medical treatments and service costs.

Section 3:

Navigating FICA Taxes with Syed Professional Service:

Now that we’ve demystified FICA taxes, let’s explore how Syed Professional Service can assist you in navigating this complex terrain.

- Expert Guidance:

-

- Syed Professional Service provides expert guidance on understanding FICA tax implications, ensuring you know your obligations and rights well.

- Payroll Compliance:

-

- Staying compliant with payroll tax regulations is crucial. Syed Professional Service helps businesses and individuals ensure accurate payroll processing, reducing the risk of penalties and compliance issues.

- Tax Planning:

-

- Planning for FICA taxes is an integral part of overall tax planning. Syed Professional Service works with clients to optimize tax strategies, considering FICA implications and exploring avenues for potential savings.

- Consultation on High-Income Scenarios:

-

- For high-income earners subject to additional Medicare taxes, Syed Professional Service offers specialized consultation to navigate the complexities of these scenarios and minimize tax liabilities.

- Representation in Audits:

-

- Syed Professional Service provides representation during FICA-related audits, ensuring clients’ rights are protected and helping them navigate the audit process effectively.

Conclusion:

In the realm of taxes, understanding and navigating FICA taxes are fundamental to financial well-being. Syed Professional Service is your ally in unravelling the complexities of Social Security and Medicare taxes. From expert guidance to strategic tax planning, Syed Professional Service is committed to confidently helping individuals

and businesses navigate the intricate world of FICA taxes. Choose Syed Professional Service to ensure your financial journey is compliant and optimized for success.