Introduction:

- In the complex landscape of United States taxation, the Federal Income Tax stands out as a crucial aspect affecting individuals and businesses alike. This comprehensive guide aims to demystify the intricacies of federal income tax, shedding light on its fundamental principles, regulations, and the role that Syed Professional Service can play in navigating this intricate domain.

I. Federal Income Tax: An Overview

Definition and Purpose:

The Federal Income Tax is a progressive tax the federal government imposes on individuals and businesses based on income. Its primary purpose is to fund government programs and services, contributing to the overall functioning of the nation.

Progressive Tax System:

One notable characteristic of the Federal Income Tax is its progressive nature. Encouraging an even allocation of taxation responsibility, those with higher earnings are subject to steeper tax rates.

Taxable Income:

Understanding what constitutes taxable income is crucial. It includes wages, salaries, dividends, capital gains, and other sources of income. However, certain deductions and credits can influence the final taxable income amount.

II. Key Components:

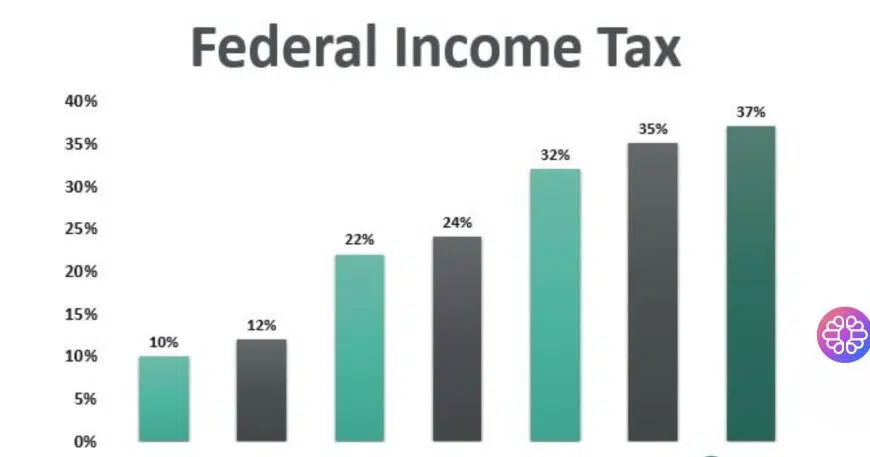

Tax brackets and rates:

The Federal Income Tax is organized into brackets, each with its corresponding tax rate. As income increases, individuals move into higher brackets, resulting in a higher percentage of their income being taxed.

Deductions and Credits:

Taxpayers can reduce their taxable income through deductions and credits. Standard deductions include those for mortgage interest, medical expenses, and charitable contributions, while credits directly reduce the tax owed.

Filing Status:

Filing status, such as single, married, filing jointly, or head of household, can significantly impact tax liability. Each group has its own set of rules and tax implications.

III. Syed Professional Service: Your Guide through the Tax Maze

Expertise in Tax Planning:

Syed Professional Service specializes in tax planning, helping individuals and businesses optimize their financial strategies to minimize tax liability legally. Identifying potential options for tax reductions, monetary incentives, and credit eligibility is part of the process.

Navigating Tax Laws and Regulations:

The ever-evolving tax landscape requires constant vigilance. Syed Professional Service stays abreast of the latest tax laws and regulations, ensuring clients remain compliant while taking advantage of any available tax benefits.

Personalized Consultation:

Understanding that each client’s financial situation is unique, Syed Professional Service offers personalized consultation services. Whether maximizing deductions, exploring credits, or addressing specific tax concerns, clients receive tailored advice to meet their needs.

Efficient Tax Preparation:

Syed Professional Service excels in efficient and accurate tax preparation. By leveraging advanced tools and expertise, clients can have peace of mind knowing their tax returns are prepared meticulously and according to the latest regulations.

Conclusion:

In conclusion, federal income tax in the US is a multifaceted system that demands a nuanced understanding. Navigating this intricate landscape requires expertise, and this is where Syed Professional Service excels. By offering personalized guidance, staying current with tax laws, and optimizing tax strategies, Syed Professional Service is your trusted partner in ensuring financial success while maintaining compliance with tax regulations.