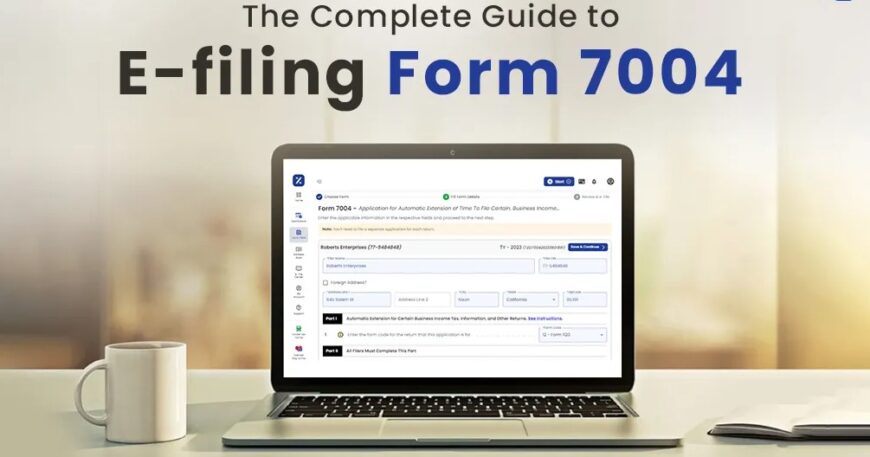

DTax Extensions: Using Form 7004 with Syed Professional Service

Tax season can be a stressful time, especially when deadlines loom. If you find yourself needing more time to file certain business tax returns, understanding Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, becomes crucial. This informative guide by Syed Professional Service clarifies the purpose […]