Conquering Tax Deadlines with Confidence: Complete Guide with Syed Professional Services

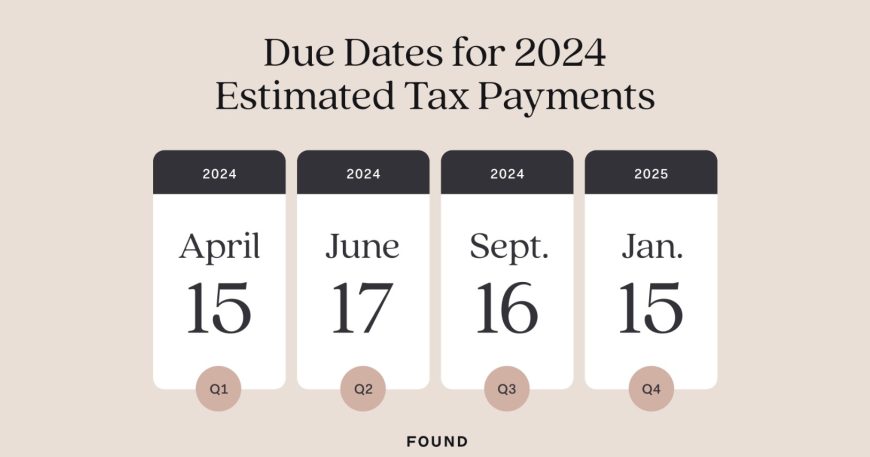

The due date for your taxes depends on a few factors, including: Individual vs. Business Taxes: Individual income tax deadlines differ from business tax deadlines. Federal vs. State Taxes: The IRS sets Federal tax deadlines, while state deadlines vary. Tax season can be a whirlwind of forms, deadlines, and calculations. Navigating these complexities can be daunting., But […]