Form 1042, “Annual Withholding Tax Return for U.S. Source Income of Foreign Persons,” summarizes the information reported on all Forms 1042-S filed for the tax year. Here’s how Syed Professional Services

Form 1042, along with Forms 1042-S and 1042-T, are Internal Revenue Service (IRS) tax forms used to report payments made to foreign persons. It includes nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts.

Here’s a breakdown of the critical functions of each form:

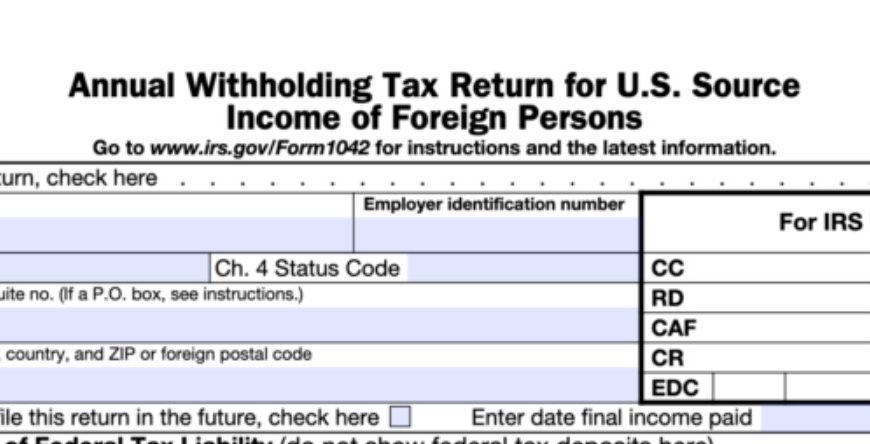

- Form 1042 (Annual Withholding Tax Return for U.S. Source Income of Foreign Persons): This form is used by withholding agents (typically U.S. businesses or institutions) to report the amount of federal income tax withheld on certain income paid to foreign persons. It summarizes the information reported on Forms 1042-S filed for the tax year.

- Form 1042-S (Foreign Person’s U.S. Source Income Subject to Withholding): This form is filed by the withholding agent to report details about each separate payment made to a foreign person during the tax year. It includes information such as:

- The name and address of the foreign person.

- The amount of income paid.

- The type of income (e.g., interest, dividends, royalties).

- The amount of tax withheld.

- Form 1042-T (Triennial Report of Foreign Trusts or Estates with U.S. Beneficiaries): This form, filed every three years, is used to report certain information about foreign trusts or estates that have U.S. beneficiaries.

Who Needs to File Form 1042 and 1042-S?

Any U.S. person (individual or business) or foreign entity that makes certain payments to foreign persons may need to file Form 1042-S. It applies even if the payment is exempt from taxation due to a treaty or tax exception. The withholding agent is then responsible for summarizing the information on Form 1042.

When to File Form 1042 and 1042-S?

- Form 1042-S is typically due on or before March 15th of the following year for payments made during the previous calendar year.

- Form 1042 is generally due on or before April 15th of the following year, along with a copy of all Forms 1042-S filed for the tax year.

How to File:

- Both electronic and paper filing options are available. The IRS encourages electronic filing whenever possible.

Deposit Requirements:

- To deposit withheld taxes, you will use the Electronic Federal Tax Payment System (EFTPS) and report the frequency of these deposits through Form 1042. The deposit frequency hinges on the amount of the withheld tax.

Penalties for Not Filing:

- Failure to file Forms 1042 and 1042-S on time can result in penalties.

Understanding Form 1042-S Instructions:

Form 1042-S, titled “Foreign Person’s U.S. Source Income Subject to Withholding,” is used by withholding agents (typically U.S. businesses or institutions) to report details about income paid to foreign persons during the tax year. Here’s a breakdown of the critical points in the instructions:

- Form 1042-S Requires: The duty of filing Form 1042-S for every payment made to non-US residents falls on the withholding agents, regardless of whether the withholding of tax occurred or not, that took place during the relevant tax year.

- Form 1042-S serves as a means to document important details of a financial transaction, noting vital information like:

- Foreign person’s name and address.

- Type of income paid (e.g., interest, dividends, royalties).

- Amount of income paid.

- Amount of tax withheld (if applicable).

- Tax treaty benefits claimed (if applicable).

Instructions for Form 1042-S can be found here:

https://www.irs.gov/pub/irs-pdf/i1042s.pdf

The Role of Syed Professional Services in Form 1042-S:

Syed Professional Services can be a valuable asset in navigating Form 1042-S:

- Determining Filing Requirements: They can help you understand if you qualify as a withholding agent. Therefore, you need to file Form 1042-S for payments made to foreign persons.

- If you need to fill out Form 1042-S, Syed Professional Services can help you ensure that the form is completed accurately. It can help you avoid any errors and potential penalties from the IRS. They have the expertise to help you navigate the process and complete the form correctly.

- Staying Updated on Regulations: Tax laws and withholding requirements for foreign persons can change. Syed Professional Services stays updated on these updates to ensure you’re filing by the latest regulations.

Understanding Form 1042 and How Syed Professional Services Can Help:

Form 1042, “Annual Withholding Tax Return for U.S. Source Income of Foreign Persons,” summarizes the information reported on all Forms 1042-S filed for the tax year. Here’s how Syed Professional Services can assist:

- Understanding When to File: They can clarify the deadline for filing Form 1042, typically April 15th of the following year, along with all Forms 1042-S for the tax year.

- Ensuring Accurate Withholding: Syed Professional Services can help you calculate the correct amount of tax to withhold on payments to foreign persons.

- Depositing Withheld Taxes: They can guide you through using the Electronic Federal Tax Payment System (EFTPS) to deposit the withheld tax as required by the IRS.

Overall, Syed Professional Services can act as your partner in navigating the complexities of withholding tax for foreign persons. They can help you with both Forms 1042-S and 1042. They ensure accurate filing, minimize the risk of penalties, and keep you compliant with IRS regulations.