Tax season can be stressful, especially if you need more time to be ready to file your return by the deadline. But fear not, the IRS offers a lifeline – the tax extension. This informative guide by Syed Professional Service dives into everything you need to know about tax extensions for the 2023 tax year. Including deadlines, benefits, and how our team can help you navigate the process smoothly.

Understanding Tax Extensions: A Reprieve, Not a Free Pass

A tax extension grants you additional time to file your federal income tax return beyond the traditional April 15th deadline (October 15th, 2024, for the 2023 tax year). However, it’s crucial to understand that a tax extension is not an extension to pay any taxes you may owe.

Key Points About Tax Extensions for 2023 Taxes (to be Filed in 2024):

- Deadline: The deadline to file for a tax extension for the 2023 tax year was typically April 15th, 2024. You can only file for an extension for 2023 taxes if you have met this deadline.

- Benefits: A tax extension grants you an additional six months to file your return, giving you more time to gather necessary documents, consult a tax professional, or address any complexities in your tax situation.

- Estimated Tax Payment: While the extension allows more time to file, you are still responsible for evaluating and paying any taxes owed by the original deadline (typically April 15th). Penalties and interest may accrue on any unpaid taxes after that date.

Who Should Consider Filing a Tax Extension?

Tax extensions can be beneficial for various situations. Here are some common reasons to consider filing:

- Incomplete Records: If you still need to gather all your tax documents (W-2s, 1099s, receipts, etc.) by the deadline, an extension gives you more time to organize and compile everything.

- Complex Tax Situation: If your tax situation involves multiple income sources, business ownership, investments, or other complexities, an extension allows for a more thorough review and filing process.

- Need Professional Help: If you plan to consult a tax professional but have yet to select one or require additional time to work with your chosen professional, a tax extension can provide the necessary breathing room.

How to File for a Tax Extension:

The IRS offers several ways to file for a tax extensions:

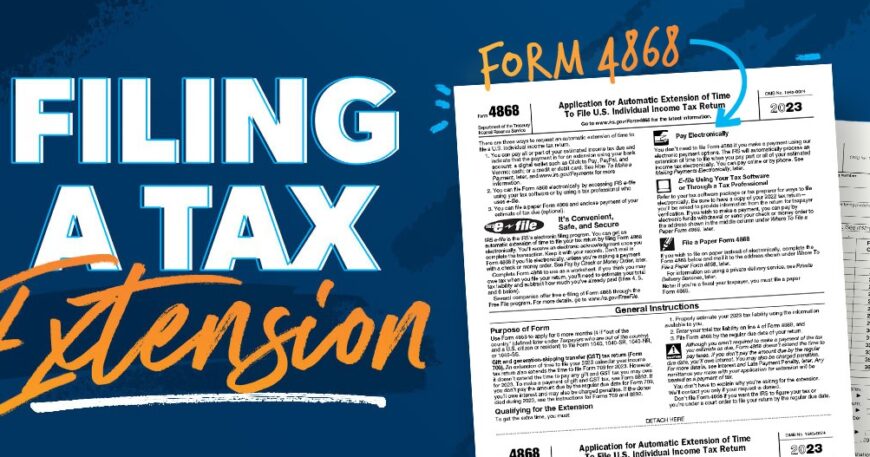

- Electronically: Individuals can electronically file Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, through the IRS website or authorized tax preparation software.

- By Mail: You can mail a completed Form 4868 to the designated IRS address.

- Tax Professional: A tax professional can file the extension electronically or by mail.

Syed Professional Service: Your Partner in Navigating Tax Extensions

Even with a tax extension, tax season can still feel overwhelming. Syed Professional Service can be your trusted partner throughout this process:

- Extension Assessment:. We can help you determine if a tax extensions suits your situation and ensure you file it before the deadline.

- Estimated Tax Payment Calculation:. We can assist you in evaluating your tax liability and ensure you make the necessary estimated tax payment by the original deadline to avoid penalties and interest.

- Tax Return Preparation: While the extensions buys you time to file, we can diligently prepare your tax return accurately and efficiently. Ensuring you take advantage of all deductions and credits you deserve.

- Ongoing Tax Support: Beyond tax extensions. We offer comprehensive tax services throughout the year, helping you stay organized and informed about tax regulations.

Don’t Wait Until the Last Minute

While a tax extensions provides valuable extra time, being proactive is essential. Contact Syed Professional Service today to discuss your tax situation and explore your options. We can help you file an extension if necessary, ensure timely estimated tax payments. And ultimately guide you toward a smooth and successful tax filing experience. Remember, a little planning goes a long way in confidently navigating tax season.