The world of international finance can be complex, especially when navigating tax regulations. For U.S. taxpayers with foreign financial assets, Form 8938 is crucial in ensuring compliance with the Foreign Account Tax Compliance Act (FATCA). This informative guide by Syed Professional Services sheds light on Form 8938, its filing requirements, and how our team can assist you in completing it accurately and efficiently.

Understanding Form 8938: Reporting Foreign Financial Assets

Form 8938, officially titled “Statement of Specified Foreign Financial Assets,” is an Syed Professional Services form used by U.S. taxpayers to report certain foreign financial assets held during the tax year. FATCA, a key piece of tax legislation, aims to prevent tax evasion by U.S. taxpayers using foreign accounts. Form 8938 serves as a mechanism for the IRS to gain visibility into these foreign assets and ensure proper tax reporting.

Who Needs to File Form 8938? Understanding the Filing Requirements

Only some U.S. taxpayers with foreign financial assets need to file this Form . Here’s a breakdown of the filing requirements:

- Thresholds: You generally only need to file Form 8938 if the total value of all your specified foreign financial assets exceeds a certain threshold at any point during the tax year. These thresholds are:

- $50,000: This applies to single filers and married filing separately.

- $100,000 applies to married filing jointly if both spouses meet the residency test.

- Specified Foreign Financial Assets: The types of assets that qualify as “specified foreign financial assets” include:

- Foreign bank accounts

- Brokerage accounts held outside the U.S.

- Mutual funds held in foreign accounts

- Certain foreign trusts and estates

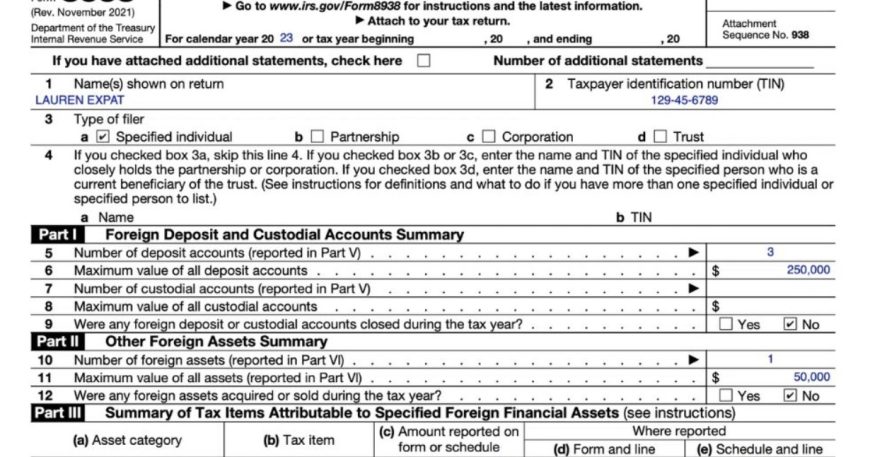

Navigating Form 8938: Key Sections and Information Required

While Form 8938 may appear daunting, it’s relatively straightforward once you understand its components. Here are some key sections:

- Part I: Taxpayer Information: Fill in your primary contact and tax return details for the year.

- Part II: Specified Foreign Financial Assets: Indicate the types of foreign financial assets you hold and their locations.

- Part III: Maximum Value During the Year: Report the highest combined value of all your specified foreign financial assets at any point during the tax year.

- Part IV: Additional Information: This section might require details about foreign trusts or certain income earned on your foreign assets.

Common Mistakes to Avoid When Filing Form 8938

Here are some pitfalls to avoid when dealing with this Form :

- Missing the Filing Deadline: This Form is typically attached to your regular tax return and is subject to the same filing deadline. Missing the deadline can lead to penalties.

- Inaccurate Reporting: Ensure all information, including the maximum value of your assets and any income generated, is accurate and complete.

- Failing to File When Required: Even if you don’t owe taxes, not filing this Form when you meet the filing requirements can result in penalties.

Syed Professional Services: Your Trusted Partner for Form 8938 Filing

Filing Form 8938 can be complex, especially for individuals with significant foreign assets or intricate financial situations. Syed Professional Services can be your guide through this process, offering:

- Filing Requirement Assessment: We can help determine whether you must file this Form based on your circumstances.

- Form Completion Assistance: Our tax professionals can guide you through this Form , ensuring all sections are filled out accurately and completely.

- Accurate Value Determination: We can assist in determining the maximum value of your foreign assets during the tax year for precise reporting.

- Avoiding Errors and Penalties: By partnering with us, you can minimize the risk of errors and potential penalties associated with this Form filing.

Conclusion: Peace of Mind with Form 8938

Understanding Form 8938 and its filing requirements is crucial for U.S. taxpayers with foreign financial assets. By familiarizing yourself with the key points and seeking guidance from Syed Professional Services. You can ensure proper compliance and navigate the complexities of FATCA reporting with peace of mind. Remember, we are here to help you navigate the ever-changing world of tax regulations. And ensure you meet your filing obligations accurately and efficiently.