Staying on top of your mailing address updates with the IRS is crucial for ensuring smooth communication and timely receipt of essential tax documents like refunds or notices. This informative guide by Syed Professional Services explores IRS Form 8822 and 8822-B, designed to notify the IRS of address changes. It explains how our comprehensive services can streamline the process for you.

Understanding the Importance of Updating Your Address with the IRS

The IRS relies on your mailing address for critical communication, including:

- Tax Return Processing: The IRS needs your correct address to process your tax return and send you any refund or correspondence.

- Stimulus Payments: If eligible for stimulus payments or other tax benefits, informing the IRS of your current address ensures you receive them without delays.

- Audit Notices: In the unlikely event of an IRS audit, timely communication is essential. An outdated address could lead to missed notices and potential complications.

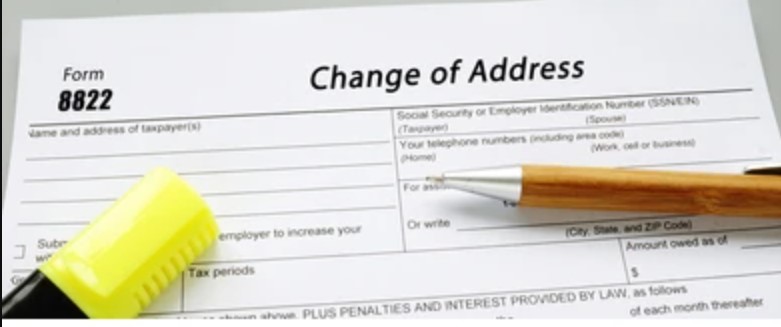

Form 8822: Your Go-To for Home Address Changes

IRS Form 8822, titled “Change of Address,” is used to notify the IRS of a change in your home mailing address. It applies to individuals as well as married couples filing jointly.

Key Points About Form 8822:

- Form 8822 is a simple means of informing the IRS when one’s residential mailing address has been subject to change. Bringing forth the corresponding information such as both the current and new addresses, Social Security number(s), and filing status (apart from the possession of a joint filing status, if applicable) is vital and must be entered correctly in the given form.

- When to File: Ideally, submit Form 8822 at least two weeks before your address change takes effect.

Form 8822-B: For Business Address Updates

For businesses like sole proprietorships, partnerships, corporations, and LLCs, changing your address is a process that works differently per entity. To execute this mission, entrepreneurs must finish up IRS paperwork 8822-B, titled “Change of Address or Responsible Party.”

Key Points About Form 8822-B:

- Form 8822-B is available for those who wish to notify the IRS of changes to their mailing address or the designated “responsible party” authorized to receive tax-related correspondence for their company. The form is designed specifically for this purpose.

- What Information is Needed: Similar to Form 8822, you’ll need to provide old and new addresses. Employer Identification Number (EIN), and information about the responsible party.

- Timing is crucial when it comes to filing Form 8822-B for address changes. To ensure a smooth transition, it is advisable to submit the form a minimum of two weeks prior to the change becoming effective, as with Form 8822.

Beyond the Forms: Additional Considerations

- Update with USPS: While filing the appropriate IRS form is crucial. Updating your address with the United States Postal Service (USPS) is essential to ensure mail forwarding to your new address.

- Notify Other Parties: Remember to update your address with other institutions that send you essential mail, such as banks. Credit card companies, and benefit providers.

Syed Professional Services: Ensuring Smooth Communication with the IRS

At Syed Professional Services, we understand the importance of efficient communication with the IRS. We can help you navigate address changes and ensure a smooth transition:

- Choosing the Right Form: Based on your situation, we’ll help you determine whether you need Form or Form 8822-B.

- Precision in Form Submission: Our expert assistance will guide you towards accurately completing the requisite form and guarantee all relevant details get included.

- Timely Filing: We can help you submit the form to the IRS promptly to minimize any potential communication delays.

- Additional Tax Services: Our comprehensive tax services go beyond address changes. We can assist you with tax preparation, filing, and representation, ensuring a stress-free tax season.

Focus on Your Business or Life, We’ll Handle the IRS Communication

Don’t let address changes become a source of frustration or missed IRS communication. Syed Professional Services is here to streamline the process and ensure you stay connected with the IRS. Contact us today to discuss your situation and explore how our expertise can simplify your tax administration.

Additional Resources:

- IRS Website – Change of Address: The IRS website https://www.irs.gov/faqs/irs-procedures/address-changes/address-changes provides information on address changes and links to download Forms 8822 and 8822-B.