Understanding IRS tax transcripts is crucial for maintaining effective finances and meeting tax regulations, so this comprehensive guide aims to explain everything from their definition to, their purpose. How quickly one can be obtained online – Syed Professional Services has all of the knowledge you require for this process seamlessly.

What Is a Tax Transcript?

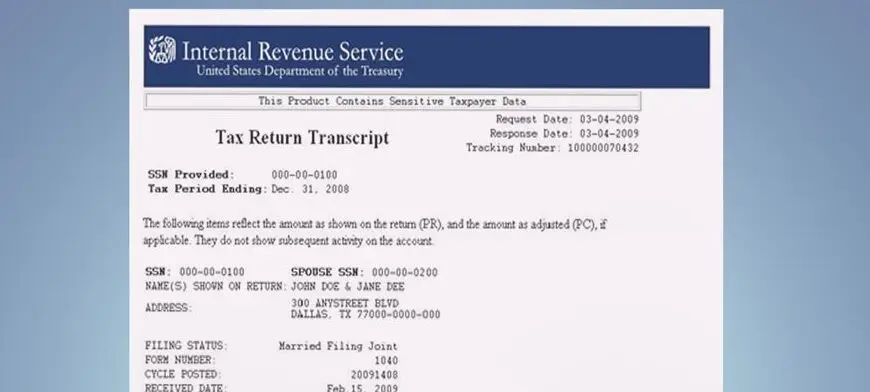

A tax transcript is an official summary of your original tax return provided by the Internal Revenue Service (IRS), including most line items and any new information the IRS has on file. Unlike a full tax return, however, a transcript only offers an overview for verification purposes and should be treated accordingly.

There are various kinds of tax transcripts, each tailored to meet different requirements:

Tax Return Transcript: Displays most items from your original tax return as filed. Tax Account Transcript: Provides basic data including return type, marital status, adjusted gross income, and taxable income.

Record of Account Transcript: Consolidates tax return and account transcript data into one comprehensive document. Wage and Income Transcripts: Display data from information returns such as W-2s and 1099s in one document.

Verification of Non-Filing Letter: Provides evidence to demonstrate that no tax return was filed during a particular year with the IRS.

Tax Transcripts Are Essential

A tax transcript can be indispensable in many scenarios. They’re commonly required when applying for mortgage or loan financing, verifying income for financial aid applications, or dealing with tax issues like audits or disputes – having access to these transcripts allows you to ensure that your records remain up-to-date and accurate.

IRS Tax Transcript

The Internal Revenue Service offers free tax transcripts. They can be requested online, over the phone, or by mail – although online is the fastest and easiest method.

How Can I Access My Tax Transcript Online Instantaneously?

To quickly obtain your tax transcript online, take these steps:

Create an IRS Account: For those without one already, visit the IRS website to open one if necessary they’ll need their Social Security number, email address, and mailing address.

Verify Your Identity: Afterward, visit IRS Verification Services to authenticate yourself as you will need this.

Verification will require providing financial details such as your credit card or loan account numbers. Once verified, please access the Get Transcript Tool:

Once your account has been set up and verified, use the IRS Get Transcript tool to view and print your transcript.

Select Transcript Type and Year before clicking “Get Transcript.”

Choose the type of transcript and tax year information needed from us, then download and print for your records. Alternatively, request the transcript via mail or phone call.

If you prefer not to use the online method, you can order your tax transcript via mail or phone instead. Here’s how:

By Mail:

Complete and mail IRS Form 4506-T or 4506T-EZ to the IRS. It can be found online. By Phone:

Call the IRS at 1-800-908-9946 and follow their automated prompts for requesting your transcript; expect it in 5-10 days depending on whether it was requested via mail or phone.

Understanding When and Why You May Require a Tax Transcript

Being prepared for various financial situations means understanding when and why a tax transcript might come in handy:

Mortgage Applications:. Lenders often request tax transcripts to verify your income and tax filing status before offering you a mortgage loan.

Student Financial Aid: Colleges and universities may request your tax transcripts to verify your income for financial aid purposes.

Tax Prep and Filing:. A transcript can help ensure that your tax preparer files your return accurately or amends an older one.

Resolving Tax Disputes:

If you find yourself involved in an audit or dispute with the IRS, having access to your tax transcript could provide the evidence necessary for the resolution of these matters.

Sometimes when ordering your tax transcripts, issues arise that must be overcome. Here are some common problems and their solutions:

Correct Information: Whilst providing any details to the IRS is key for expeditious processing, any discrepancies could cause delays and cause delays to your claims being reviewed by them.

Identity Verification Failure: for some reason you were unable to verify your identity online, another method may need to be explored such as mail or phone requests.

Account Lockout: Multiple failed attempts at signing in or verifying your identity could result in your account becoming locked out. So wait 24 hours before retrying or contact the IRS for assistance.

Conclusion

Generating a tax transcript is an easy and quick online process that takes less than 5 minutes. Being aware of all the various types of transcripts available and their uses will help you manage financial records more effectively while remaining compliant with tax regulations. Syed Professional Services stands ready to assist at every step along the way!

No matter if it’s for mortgage applications, financial aid applications, or tax issues;

having your tax transcript can make a real difference in how quickly and smoothly everything goes. Use the steps outlined above to obtain it quickly online – stay on top of your finances!