Tax season can be a whirlwind of forms and deadlines. While Form 1040 remains the core of your tax return, Form plays a crucial role in the electronic filing process. This informative guide by Syed Professional Service clarifies the purpose of Form 8879, explores its key differences from Form 1040, and explains how our team can help you quickly navigate e-filing.

Demystifying Form 8879: The E-file Authorization Form

Form 8879, titled “Authorization for Electronic Filing,” serves one specific purpose: granting your tax preparer or electronic return originator (ERO) permission to submit your tax return to the IRS electronically. Unlike Form 1040, which reports your income, deductions, and tax liability,This Form focuses solely on the authorization aspect of e-filing.

Understanding the Key Differences Between Form 8879 and Form 1040

While both forms are essential for tax filing, they serve distinct purposes:

- Form 1040 (and its various versions): This core form reports your income from multiple sources (wages, interest, dividends, etc.), deductions you qualify for (itemized or standard), and ultimately calculates your tax liability. It tells the IRS your financial story for the tax year.

- Form 8879 acts as your electronic signature, authorizing your tax preparer or ERO to submit your completed Form 1040 (and any applicable schedules) to the IRS electronically. You don’t submit the Form directly to the IRS; your tax preparer retains it for their records.

Who Needs to Use Form 8879?

If you plan to file your tax return electronically through a tax preparer or ERO, you’ll need to complete this Form. This authorization grants them the right to submit your return electronically using their IRS-approved software.

Understanding the Sections of Form 8879

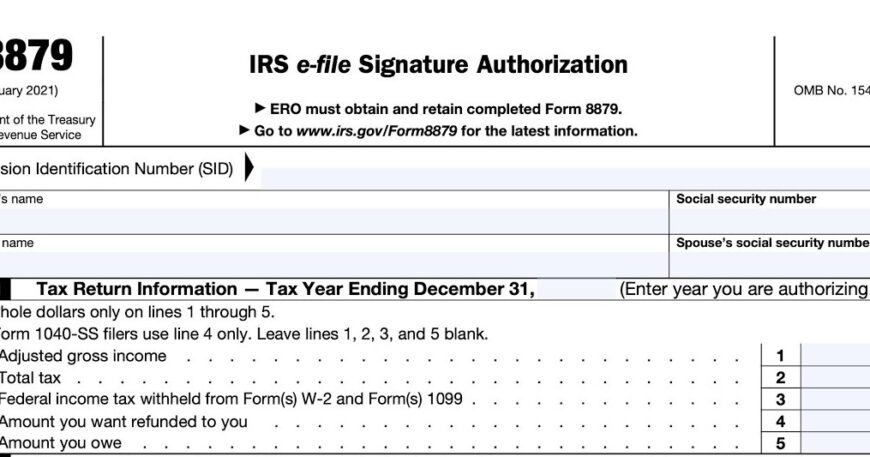

While seemingly simple, Form 8879 has a few key sections to complete:

- Taxpayer Information: This section gathers your basic information, including your name, Social Security number, and filing status.

- Tax Return Information: Here, you’ll identify the tax return you authorize for e-filing (e.g., Form 1040, Form 1040-SR for seniors).

- Signature and Verification: You’ll sign and date the form, verify your identity, and grant e-filing authorization. Your tax preparer must also affix their signature and details to this part.

Beyond Form 8879: Maximizing Your E-filing Experience

While Form 8879 plays a vital role, here are some additional considerations for a smooth e-filing experience:

- Choosing a Tax Preparer: Select a reputable tax preparer with experience in e-filing and familiarity with your tax situation.

- Gathering Documentation: Ensure you have all the necessary documents (W-2s, 1099s, receipts, etc.) readily available to provide to your tax preparer for accurate return preparation.

- Reviewing Your Return: Before granting e-filing authorization, carefully review your completed Form 1040 and any attached schedules with your tax preparer to ensure accurate information.

Syed Professional Service: Your Partner in Streamlined E-filing

Navigating e-filing and Form 8879 can be a simple process. Syed Professional Service can be your trusted partner throughout this process:

- E-filing Expertise: Our tax professionals are well-versed in electronic filing procedures and can ensure your return is submitted securely and efficiently.

- Form 8879 Completion Guidance: We can walk you through completing Form accurately, ensuring explicit authorization for e-filing.

- Tax Return Accuracy: Our team meticulously prepares your Form 1040 and maximizes all deductions and credits for optimal tax savings.

- Communication and Support: We will communicate openly throughout the process and address any questions or concerns you may have.

Embrace the Efficiency of E-filing

By working with Syed Professional Service, you can leverage the convenience and security of e-filing while ensuring your tax return is prepared and submitted accurately. Don’t let Form 8879 become a hurdle; let our team guide you towards a streamlined and stress-free