Introduction

The excitement of receiving your tax refund can quickly overshadow the anxious waiting game. Whether you’re eagerly anticipating Track My Refund or a state refund, tracking the status of your refund is an essential part of the tax filing process. At Syed Professional Services, we understand how important it is to stay informed about your refund status. In this blog post, we’ll guide you through tracking your IRS and state refunds so you can know exactly when to expect your hard-earned money.

Tracking Your IRS Refund: A Step-by-Step Guide

Track My Refund: the IRS makes it relatively easy to track the status of your federal tax refund. If you’ve filed your taxes and are now wondering, “Where is my IRS refund?” follow these steps to find out where it is in the process.

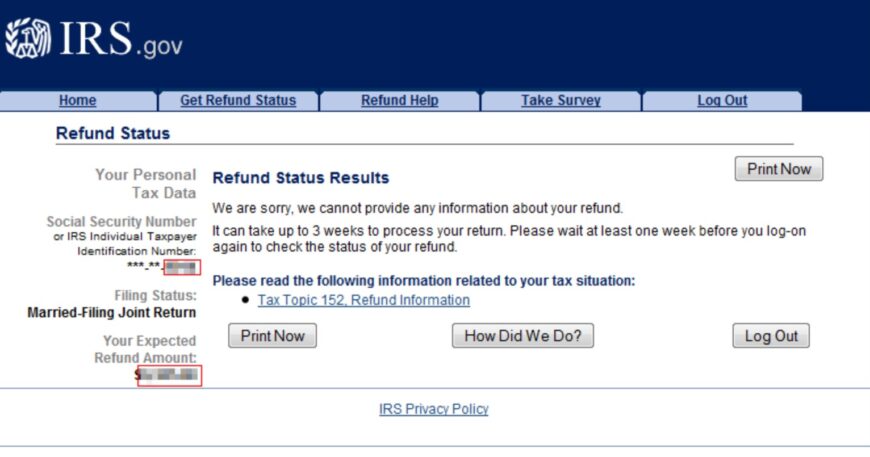

1. Use the IRS ‘Where’s My Refund’ Tool

The fastest way to track your IRS refund is by using the official Where’s My Refund? Tool provided on the IRS website.

Here’s how to track your refund using this tool:

- Visit the IRS website: Go to the official IRS website at www.irs.gov.

- Click on ‘Where’s My Refund?’ You’ll find the link to this tool on the IRS homepage.

- Enter Your Information: You’ll need to provide your Social Security Number (SSN), filing status (single, married, etc.), and the exact refund amount.

- View Your Refund Status: After entering the required details, you’ll see your refund status. It could be listed as:

- Accepted: The IRS has received and processed your tax return.

- Approved: Your refund is on its way.

- Sent: Your refund has been issued.

2. Use the IRS2Go Mobile App

If you prefer using a smartphone, the IRS2Go app is an excellent option for tracking your IRS refund. Available for both Android and iOS devices, the app offers the same functionality as the online tool.

3. Call the IRS Refund Hotline

If you don’t have access to the internet or prefer speaking with someone, you can call the IRS refund hotline at 1-800-829-1954. Have your details ready, and you’ll be able to get the status of your refund over the phone.

How Long Does It Take for the IRS to Process My Refund?

Typically, the IRS processes refunds within 21 days if you e-file and opt for direct deposit. If you mailed a paper return, however, you can expect to wait 6-8 weeks.

The IRS may delay refunds if there are issues with your return, such as mistakes or additional review requirements. This is why using the Where’s My Refund tool regularly is so important to stay updated.

How to Track My Refund: A Quick Overview

While tracking your IRS Track My Refund is straightforward, many people also want to know how to track their state refunds. Fortunately, many states offer similar tools to Track My Refund state tax refund.

1. Visit Your State’s Department of Revenue Website

Each state has its system for tracking refunds. To find out how to track your state refund, visit your state’s Department of Revenue or Taxation website. Most states have a “Track Your Refund” page where you can input your Social Security Number (SSN), filing status, and the refund amount to check your refund status.

2. Check the Status Using a Mobile App

Some states also offer mobile apps that allow you to track your state refund. Just like the IRS2Go app for federal refunds, these apps provide real-time updates on your state tax refund.

3. Call Your State Department of Revenue

If you’re unable to track your state refund online or through a mobile app, you can always call the customer service number provided by your state’s tax department. Be ready with your personal information to verify your identity.

Can I Track My State Refund?

Absolutely! If you’ve filed a state tax return, you can Track My Refund state refund just like the IRS refund. However, it’s important to note that each state’s tracking system may differ slightly. You will need to provide similar information: Social Security Number (SSN), filing status, and the exact refund amount.

Why You Should Track Your Refunds Regularly

Tracking your IRS and state refunds regularly is crucial for the following reasons:

- Avoiding Delays: If the IRS or your state’s tax department needs additional information, Track My Refund can alert you to any issues early.

- Peace of Mind: Staying up to date with your refund status helps ease anxiety during tax season.

- Ensuring Accuracy: Regular tracking allows you to catch any discrepancies, such as incorrect refund amounts or wrong direct deposit details before they become major problems.

If you encounter any problems or delays, Syed Professional Services is here to assist. We can help you resolve any issues with your tax returns, ensuring a smooth process from start to finish.

What to Do If My Refund Is Delayed

Sometimes, despite all the preparation, your refund can be delayed. If your IRS refund or state refund is taking longer than expected, here are a few possible reasons and what you can do:

- Errors on Your Return: Mistakes such as incorrect personal information or missing documents can delay processing.

- Additional Review: The IRS or state may flag your return for further review, which can extend processing times.

- Refund Method: Paper checks generally take longer than direct deposits, so consider choosing the latter for faster processing.

If your refund has been delayed for more than a few weeks, reach out to Syed Professional Services. We can assist with contacting the IRS or your state’s tax department to resolve the issue.

Conclusion

Whether you’re tracking your IRS refund or your state refund, knowing how to monitor your tax return status is essential. With tools like the IRS Track My Refund ? With a website and state-specific tracking systems, it’s easier than ever to keep tabs on your refund. If you encounter any issues, Syed Professional Services is here to help. Our expert team can assist with tracking your refund, resolving delays, and answering any questions you may have.

Don’t let the waiting game stress you out. Track My Refund, stay informed, and reach out to us for any assistance you need!

Frequently Asked Questions (FAQs)

How can I track my refund?

To track your IRS refund, use the IRS “Where’s My Refund?” tool on their website or download the IRS2Go app. You’ll need your SSN, filing status, and refund amount.

How do I track my refund?

Visit your state’s Department of Revenue website, where you can input your SSN, filing status, and refund amount to check your state refund status.

How long does it take for the IRS to process my refund?

If you e-file and opt for direct deposit, you can expect to receive your IRS refund in about 21 days. Paper returns take about 6-8 weeks to process.

Can I track both my IRS and state refunds?

Yes, Track My Refund both your IRS refund and your state refund. Both have online tools to check the status.

Why is my refund delayed?

Delays can happen due to errors on your return, additional review by the IRS or state, or issues with the refund method. Always Track My Refund to stay updated.

What should I do if my refund is taking longer than expected?

If your refund is delayed, contact the IRS or your state’s tax department for clarification. Syed Professional Services can help you resolve any issues quickly.