Introduction:

Navigating the complexities of taxes is an essential part of managing any business or nonprofit organization. For many, the intricacies of tax-exempt status can be a challenge, requiring professional help to ensure compliance and accurate filings. Syed Professional Services provides expertise and guidance in managing tax-exempt forms, allowing your organization to concentrate on its mission, secure in the knowledge that its financial operations are well-managed.

In this blog post, we will delve into the details of tax-exempt forms, explain their purpose, and demonstrate how Syed Professional Services can help you with the necessary paperwork. If you’re a non-profit or any other entity looking to understand tax exempt, this post will provide a comprehensive guide on what you need to know and how Syed Professional Services can make the process smooth and straightforward.

What Is a Tax Exempt Form?

A tax-exempt form is an essential document for organizations seeking to qualify for exemption from certain federal, state, and local taxes. Generally, these exemptions are available for non-profit organizations, charities, religious institutions, educational institutions, and some other qualifying entities.

The most common tax-exempt form is the IRS Form 1023 for federal tax exempt, which is used by organizations that wish to apply for 501(c)(3) status. Other variations of tax-exempt forms exist for different purposes, including for state and local tax exempt.

For many organizations, obtaining tax-exempt status offers significant benefits, such as:

-

Exemption from federal income tax

-

Reduced postal rates

-

Eligibility to receive public and private grants

-

Exemption from certain state and local taxes

These benefits are a driving force behind the need for properly completing and submitting tax-exempt forms, and that’s where Syed Professional Services can offer critical assistance.

Understanding the Importance of Tax-Exempt Status for Non-Profits

Tax-exempt status is crucial for non-profit organizations because it allows them to reinvest more of their income into their programs and services. This is especially important for organizations operating on a limited budget and relying on donations, grants, or government funding to fulfill their mission.

Securing tax-exempt status with the IRS offers several advantages:

-

Financial relief: Non-profits are not required to pay income taxes on donations or revenue generated through tax-exempt activities, meaning they can keep more funds for charitable work.

-

Increased credibility: Being recognized as a tax-exempt entity by the IRS can help build trust with donors, foundations, and grant-making organizations. Many donors prefer to contribute to tax-exempt organizations because their donations are tax-deductible.

-

Access to funding: Many grants and funding sources are only available to tax-exempt organizations. Non-profits with tax-exempt status can apply for a wider variety of funding opportunities.

These benefits make tax-exempt status a valuable tool for non-profits, and seeking assistance from professionals like Syed Professional Services ensures that the application process is thorough and accurate.

Syed Professional Services: Your Partner in Tax Exempt Form

Syed Professional Services specializes in helping organizations navigate the often-complex tax exempt process. With extensive knowledge of federal and state regulations, as well as hands-on experience in completing tax-exempt forms, Syed Professional Services is an excellent partner for any non-profit or organization looking to secure tax-exempt status.

Here’s how Syed Professional Services can help:

-

Expert Guidance:. With years of experience, Syed Professional Services offers expert guidance through the entire process of applying for tax-exempt status. From initial eligibility assessments to preparing the required documentation, the team can provide step-by-step support.

-

Accurate Filing: The process of filling out a tax-exempt form can be daunting, especially with the detailed information required. Syed Professional Services ensures that all forms are correctly filled out and submitted, reducing the risk of errors and potential delays in obtaining tax-exempt status.

-

Tailored Solutions:. Not every organization is the same, and each one may have unique needs when it comes to tax-exempt status. Syed Professional Services takes a personalized approach, ensuring that the services provided align with the specific goals and structure of your organization.

-

Ongoing Support: After receiving tax-exempt status, your organization will need to maintain compliance with IRS rules and regulations. Syed Professional Services offers continued support to help your organization stay on track with reporting requirements and other necessary filings.

Types of Tax Exempt Form for Non-Profits

While Form 1023 is the most common federal tax-exempt form, other forms may be applicable depending on the type of nonprofit or tax-exempt organization. Here’s a rundown of the most common tax-exempt forms:

-

IRS Form 1023 (Application for Recognition of Exemption):

This is the standard form for organizations seeking 501(c)(3) status. It is a comprehensive application that asks for information about the organization’s structure, purpose, and activities. -

IRS Form 1023-EZ (Streamlined Application for Recognition of Exemption):

This is a simplified version of the 1023 form available for smaller organizations that meet certain eligibility criteria. If your non-profit has gross receipts of less than $50,000 per year and assets less than $250,000, you may qualify for the streamlined process. -

IRS Form 990 (Return of Organization Exempt From Income Tax):

Once an organization receives tax-exempt status, it must file an annual Form 990 to maintain compliance. This form reports income, expenses, and activities, providing transparency for donors and the public. -

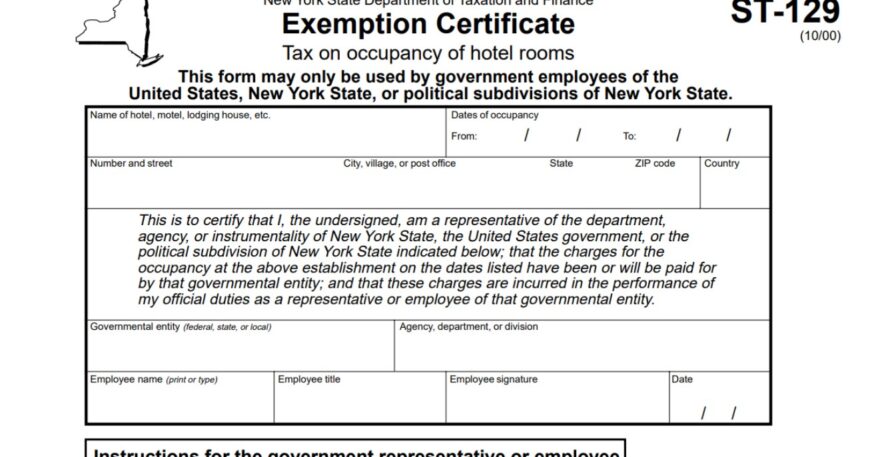

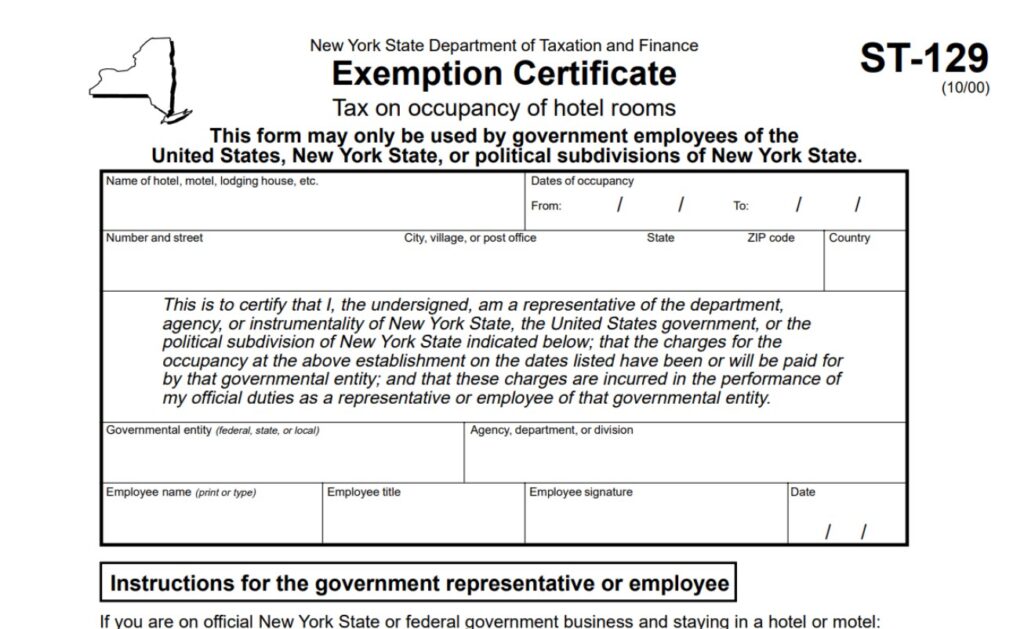

State Tax Exempt Forms:

Many states have their tax-exempt application processes and forms. These are required for state-level exemptions from sales tax, property tax, and other state taxes. Syed Professional Services is equipped to help organizations navigate both federal and state tax-exempt requirements. -

IRS Form 990-N (e-Postcard):

Smaller tax-exempt organizations with gross receipts of $50,000 or less are required to file Form 990-N, which is an electronic submission rather than the full Form 990.

How to Apply for a Tax Exempt Status with Syed Professional Services

Applying for tax-exempt status can be an involved process, but Syed Professional Services streamlines the procedure with its expertise. Here’s how the process typically unfolds when you work with Syed Professional Services:

-

Initial Consultation:

The first step in obtaining tax-exempt status is determining whether your organization is eligible. During the initial consultation, Syed Professional Services will evaluate the nature of your organization and its activities to ensure it qualifies for tax exempt. -

Document Collection:

Syed Professional Services will work with your organization to gather all the necessary documentation. This includes articles of incorporation, bylaws, a description of your activities, and financial statements. Having these documents ready is crucial to the successful completion of your application. -

Filling Out the Forms:

Based on the nature of your organization, Syed Professional Services will assist in completing the appropriate tax-exempt forms, such as Form 1023 or Form 1023-EZ. Accuracy is essential, and this is where professional help can make a big difference in ensuring that all questions are answered thoroughly. -

Submission of Forms:

Once the application forms are completed, Syed Professional Services will submit them to the IRS and handle all follow-up communication. This includes responding to any questions from the IRS or providing additional information if required. -

IRS Determination:

After submission, the IRS will review your application and decide. If approved, your organization will receive a formal recognition of its tax-exempt status. If there are any issues with the application, Syed Professional Services will work to resolve them. -

Ongoing Compliance Support:

After receiving tax-exempt status, it’s important to maintain compliance with IRS rules, including filing annual returns like Form 990. Syed Professional Services provides ongoing support to help your organization stay in good standing.

Key Considerations When Applying for Tax Exemption

Before diving into the application process, it’s essential to consider the following:

-

Eligibility: Not all organizations are eligible for tax-exempt status. You must operate for a charitable, educational, religious, or similar purpose to qualify.

-

Documentation: Proper documentation is crucial. This includes your mission statement, financial records, and governing documents.

-

Ongoing Compliance: Tax-exempt organizations must comply with ongoing IRS reporting requirements, including annual filings.

-

State and Local Regulations: Tax-exempt status may vary by state, so it’s important to understand local regulations as well.

By working with Syed Professional Services, you can ensure that all these considerations are properly addressed.

FAQs About Tax Exempt Forms

What is the difference between IRS Form 1023 and 1023-EZ?

Form 1023 is a comprehensive application for organizations with larger budgets. While Form 1023-EZ is a simplified version available to smaller organizations that meet certain criteria.

How long does it take to get tax-exempt status?

The IRS can take anywhere from 3 to 6 months to process Form 1023. Streamlined applications like Form 1023-EZ may be processed faster.

Can my organization apply for state-level tax exemption?

Yes, many states offer their tax-exempt applications. Syed Professional Services can help you with both federal and state-level exemptions.

What happens if my tax exempt application is denied?

If the IRS denies your application, Syed Professional Services can help you review the reasons for the denial and guide you through the appeals process.

Do I need a tax exempt status to accept donations?

While tax exempt status is not required to accept donations, having it allows donors to claim tax deductions, which can increase the likelihood of receiving donations.

What happens after I receive tax exempt status?

Once your status is approved. You will need to comply with ongoing IRS filing requirements, such as submitting Form 990 annually.

Conclusion

Obtaining tax exempt status is a critical step for many non-profit organizations. The process may seem complex, but with the help of Syed Professional Services, you can ensure that your application is completed accurately and submitted on time. Their expertise can save your organization time, effort, and potential headaches, allowing you to focus on what matters most: your mission and the impact you have on your community.

Whether you’re just starting a non-profit or need assistance with maintaining compliance, Syed Professional Services is your trusted partner in navigating the tax exemption landscape.