The Total Guide to Schedule 1 Tax Form: What You Should Know

When tax time comes, deciphering the different forms and schedules you must file can be overwhelming. One of those significant papers that some taxpayers may come across is the Schedule 1 Tax Form. If you are confused about what Schedule 1 is or where it plays a role in your filing of taxes, you are not alone. In this blog post, we will cover Everything you need to know about Schedule 1, such as what it is, how to use it, and why it’s important for filing your 1040 tax return.

What is Schedule 1 Tax Form?

Schedule 1 is a crucial form that the taxpayer in the United States utilizes. It is among the IRS Form 1040 set and is generally filled out for reporting extra income or adjustments to income that are not found on the 1040 tax return directly. Basically, Schedule 1 enables taxpayers to report other forms of income, including unemployment benefits, business income, rental income, and qualifying deductions.

Know how to complete and when to utilize Schedule 1 to ensure you are filing your taxes properly and following IRS requirements. Let’s explore the particular details and categories that come with Schedule 1 further.

What Is Schedule 1 Used For?

Schedule 1 is mainly employed in reporting two categories:

Other Income: This part of Schedule 1 reports income not included on Form 1040. This may be:

Unemployment benefits

Income (or loss) from business or farm

Income (or loss) from renting a property

Received alimony (for divorce agreements settled before 2019)

Gambling wins

Adjustments to Income: This section of Schedule 1 enables taxpayers to report adjustments that decrease their taxable income, which can decrease the amount they pay in taxes. Such adjustments include:

Student loan interest deduction

Contributions to retirement plans (IRAs)

Educator expenses for educators

Taxpayers must put the required entries in Schedule 1 to accurately report their total taxable income.

Why You Might Need to Fill Out Schedule 1

There are a few situations in which you will be required to complete Schedule 1, including:

If you:

Have income not reported on your Form 1040, such as self-employment or freelance income

Are entitled to tax deductions that do not fall under the general deductions

Received unemployment benefits or alimony subject to taxation

Would like to claim adjustments to your income, for example, retirement contributions

If any of the foregoing describes your situation, Schedule 1 is essential to correctly reporting your income and deductions.

Schedule 1 and the 1040 Form

It’s worth noting that Schedule 1 is done in addition to the primary 1040 form. If it applies to your case, the 1040 form will have you include Schedule-1 with your tax filing. While the 1040 form lists your general income and deductions, Schedule-1 adds the extra layers required to report on your tax situation completely.

Completing Schedule 1 helps you avoid missing any possible deductions or earnings. It also serves to make your tax return accurate and IRS-compliant. Remember that if you fail to submit Schedule 1 when necessary, you might end up with a delayed tax refund or even fines.

The 1040 Schedule 1: A Closer Look at Its Sections

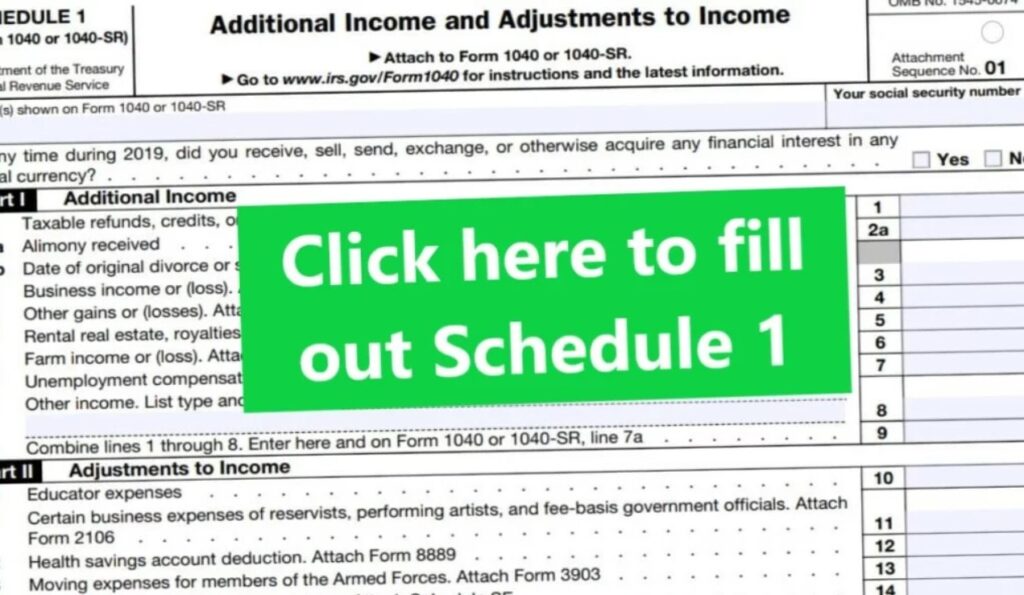

Schedule 1 consists of two primary sections:

Part 1 – Additional Income:

This section is where you’ll report income that doesn’t appear on Form 1040, such as:

Unemployment benefits

Business income (reported on Schedule C)

Rental income (reported on Schedule E)

Alimony received (if applicable)

Gambling winnings

Part 2 – Adjustments to Income:

This section will find deductions and credits that reduce your taxable income. Some of the most common adjustments include:

Student loan interest deduction

Contributions to retirement accounts like IRAs or HSAs

Educator expenses for teachers

Taxpayers must report the amounts accurately to lower their taxable income, potentially resulting in a smaller tax bill.

How to Fill Out the Schedule 1 Form

Filling out the Schedule 1 form is fairly straightforward. Here are the key steps to follow:

Personal Information: Near the top of Schedule 1, you will write your name, Social Security number, and tax year for filing.

Report Additional Income: In Part 1, report all additional income not reported on your 1040. Look at any forms related to this income that you might need, such as the 1099 for self-employment or a W-2 for unemployment benefits.

Claim Adjustments to Income: In Part 2, claim any adjustments or deductions you’re eligible for. For example, if you contributed to a traditional IRA or paid interest on a student loan, you’ll report these amounts here.

Add Everything Up: Add the amounts from Parts 1 and 2 and report the total on your Form 1040. Then, you’ll fill out the remaining portion of the 1040 form, including any additional required schedules or forms.

What Happens If You Don’t File Schedule 1?

If you miss filing Schedule 1 when required, you could face several issues. First and foremost, your tax return may be incomplete, leading to delays in processing or potentially triggering an audit. Additionally, failing to report additional income or take advantage of eligible adjustments could result in a higher tax liability than necessary.

To avoid any problems, it’s important to carefully review your tax situation and ensure you’ve filled out all the necessary forms, including Schedule 1.

FAQs About Schedule 1 Tax Form

What is Schedule 1 on a 1040 form?

Schedule 1 reports additional income and claims adjustments to income that do not appear directly on your Form 1040.

Who needs to file Schedule 1?

You’ll need to submit Schedule 1 if you have other income not included on your 1040 form, or if you’d like to claim adjustments like student loan interest or retirement contributions.

Do I have to submit Schedule 1 if I don’t have other income?

If you have no other income or are eligible for adjustments, you probably won’t be required to file Schedule 1. However, it is always best to consult with a tax preparer.

Can I electronically file Schedule 1?

You may electronically file Schedule 1 when filing your tax return using e-file.

Yes, the standard deduction is automatically applied to your tax return. However, Schedule 1 enables you to take more deductions and report income not covered under the standard deduction.

How do I obtain Schedule 1?

You may directly download Schedule 1 from the IRS website, or your tax computer program will provide it automatically when you fill out your 1040 form.

Conclusion: Streamline Your Taxes Using the Schedule 1 Tax Form

In summary, the Schedule 1 tax form is important in properly reporting your income and deductions. If you have other income to report or qualify for adjustments to income, Schedule 1 guarantees that your tax return is complete and accurate. With the understanding of the major components of Schedule 1, you can prepare confidently for tax season and ensure that you get the most out of your tax benefits.

If you need help completing your tax returns or wish to have your return prepared correctly, Syed Professional Services is here to help. Our professional staff can assist you with the preparation and ensure your taxes are correctly prepared!

How Schedule 1 Impacts Self-Employed Taxpayers

If you are self-employed, Schedule 1 is important in ensuring you accurately report all your income. Self-employed taxpayers tend to have several different income streams, including freelancing, consulting, or owning a small business. These income streams, which are normally reported on a 1099 statement, must be reported on Schedule 1.

Apart from income reporting, you can also claim self-employment expense adjustments. For example, if you are making self-employed retirement plan contributions, such contributions can be reported as adjustments on Schedule 1, lowering your taxable income.

Most self-employed taxpayers do not recognize their eligibility for many deductions, including the home office deduction or vehicle mileage. By filing Schedule 1, you can maximize these deductions and, possibly, reduce your overall tax burden.

The Advantages of Filing Schedule 1 Timely

Scheduling Schedule 1 on time will ensure that your tax return is perfect and you don’t incur unwanted penalties or delays. It’s important to remember that not filing the form when it’s due or filing an incomplete form may hold up your tax refund. For most people, a tax refund gives a welcome injection of funds, so no steps such as Schedule 1 must be skipped.

In addition, the timely filing of Schedule 1 also keeps you from being audited further by the IRS. The IRS will identify incomplete or wrong filings and ask for further documentation, leading to extensive processing times.

How Syed Professional Services Can Ensure Timely Filing of Schedule 1

At Syed Professional Services, we ensure that Everything included in your tax return is on time. Our experts stay current with all the tax laws and guide you through step-by-step submission of the necessary forms. When you initiate the tax filing process, we double-check all the details, including Schedule 1.

Schedule 1 Filing Tips

Know your sources of income: Report all sources of income accurately, be it a side job, rental income, or investment income.

Account for all qualifying deductions: Don’t neglect tax deductions! Retirement account contributions, student loan interest, and self-employment expenses can reduce taxable income.

Double check: Errors can postpone your refund or create problems with your return. Double-check all entries before filing.

What if You Fail to File Schedule 1 When You Must File It?

If you must file Schedule 1 and don’t, you could have issues with the IRS. Possible issues are:

Processing Holds: If the IRS detects that your return is lacking, it may hold up the processing of your return, and your refund may be delayed.

Other Penalties: If you are audited or the IRS detects discrepancies in your tax return, you may be penalized or fined. In some cases, these penalties can be avoided by filing amended returns on time.

Tax Liability: Failing to report additional income or claiming qualifying deductions could result in paying more taxes than required, leading to increased tax liability.

Accordingly, timely and precise filing of Schedule 1 is critical to ensuring seamless tax processing and averting penalties.

Conclusion: Simplify Your Tax Filing Process with Professional Help

Understanding the importance of Schedule 1 and how it fits into your overall tax return is critical for ensuring that your tax filings are accurate and complete. Whether you’re reporting additional income or claiming adjustments, Schedule 1 is key in reducing your taxable income and preventing potential issues.

At Syed Professional Services,

We are committed to simplifying the tax filing experience and minimizing your stress levels. We provide professional guidance in completing intricate tax returns such as Schedule 1 to ensure you benefit from all possible deductions and file your taxes accurately.

Don’t let the complexity of tax returns hold you back. With Syed Professional Services, you can file confidently, receive the maximum refund, and remain in good standing with the IRS.

Why Do You Always Choose Syed Professional Services?

Selecting Syed Professional Services for your tax and financial requirements offers many benefits that make us stand out. Here’s why clients always come back to us:

1. Tax Filing Expertise

Syed Professional Services specializes in various tax situations, including individual tax returns and complicated business filings. Whether you’re filing taxes for the first time or need to navigate confusing forms such as Schedule 1, we understand tax regulations inside and out and can guarantee that your return is accurate and up to code.

2. One-on-One Support

We recognize that each of our clients is an individual. Our staff offers customized guidance, taking the time to learn your tax case and financial objectives. We don’t simply prepare forms — we provide advice and solutions specific to your needs.

3. Extensive Services

Whether you are a self-employed freelancer, small business owner, or individual taxpayer, Syed Professional Services provides many tax services. We can assist you with filing and preparing your taxes and consultation year-round.

4. Current Knowledge

Tax laws and regulations are always changing. With Syed Professional Services, we’re on top of the newest changes in tax law to ensure your filing is up to date. This keeps you free from penalty and maximizes your accessible deductions and credits.

5. Stress-Free Filing

Tax season can be stressful, but with our professional assistance, you can sit back and rest assured that your taxes are in the hands of experts. We simplify the process, from collecting the necessary documents to submitting your returns on time.

6. Maximizing Your Refund

Our mission is to assist you in retaining as much of your hard-earned cash as possible. Through our meticulous focus on every possible deduction and credit, we make certain you do not leave money behind. Depending on your circumstances, this can translate into a bigger tax refund or lower tax bill.

7. Ongoing Support

Even during tax season, Syed Professional Services has your back. We provide year-round consultation, helping with financial planning, retirement contributions, and tax planning.

What Can Syed Professional Services Do for You?

Syed Professional Services is more than a tax preparation company. Here’s what we can help you with:

1. Tax Preparation and Filing

We offer full-service tax preparation for individuals, families, and businesses. Whether you’re completing a straightforward return or have more complicated tax requirements, our professionals will assist you through each step, guaranteeing precision and optimizing your potential refund.

2. Tax Planning and Strategy

We don’t only assist you with tax filings—we help you plan for the future. Our specialists will collaborate with you to create a tax plan that reduces your tax burden, factoring in your desired financial objectives and individual circumstances. This forward-thinking helps you maximize your finances and save money in the long term.

3. IRS Representation

Syed Professional Services provides professional representation if you’re audited or have a problem with the IRS. We will guide you through any questions or disagreements so that you are well aware and your interests are safeguarded.

4. Business TaWereneurs: We offer expert services for entrepreneurs, such as payroll tax filing, sales tax compliance, and business deductions. We will ensure your company operates according to IRS guidelines and pays as little tax as possible.

5. Financial Consulting

We provide various financial consulting services to assist you in managing your personal or business finances. This may involve budgeting, investment planning, and retirement planning. We aim to equip you with a good financial foundation for the future.

6. Tax-Advantaged Investments and Retirement Planning

We assist you in finding tax-favored investment options and contributing to retirement accounts, such as IRAs, 401(k)s, and other retirement vehicles. This way, your money works for you today and tomorrow.

7. State and Local Tax Filing

We recognize the complexities of federal and state taxation requirements. From local taxes, state returns, or multi-state taxation problems, Syed Professional Services is equipped with the knowledge to navigate these complexities.

Syed Professional Services: Your Tax Partner

With Syed Professional Services, you don’t just get a tax preparer, you get a financial partner for the long haul. From working through the intricacies of tax forms such as Schedule-1 to delivering expert advice on your finances, we see that you are always in charge of your financial well-being.

If you’re searching for an experienced, dependable, and dedicated crew for your prosperity, stop searching: Syed Professional Services is here for you. We’ll take care of the details while you enjoy what’s most important to you — whether that’s building your business, saving for retirement, or simply having peace of mind that your taxes are in capable hands.

Contact us today and discover how we can assist you in optimizing your tax benefits, maximizing your financial future, and simplifying tax season!