When doing business, understanding taxes is essential for individuals and companies. Sales tax is one of the most common forms of taxation you will encounter as a consumer and a business owner. This blog post will explore various aspects of sales-tax, including what it is, how to calculate it, how it differs from excise tax, and specifics related to New York City’s sales-tax. Our goal is to provide clear and actionable insights, especially for businesses, so you can navigate your financial obligations with confidence.

What is Sales-Tax?

Sales tax is a consumption tax imposed by the government on the sale of goods and services. In its simplest form, when you purchase a product or service, a percentage of the price is added as sales tax. This tax is typically collected by the seller and passed on to the government.

The main purpose of sales tax is to generate revenue for local, state, and federal governments. It helps fund a variety of public services such as education, healthcare, infrastructure, and more. Unlike income tax, which is based on a person’s earnings, sales tax is levied on specific transactions involving the purchase of goods and services.

Types of Sales Tax

- State Sales Tax: Each state in the U.S. can set its sales tax rate. As a result, sales-tax can vary significantly from state to state.

- Local Sales Tax: In addition to the state sales-tax, many cities and counties also impose their own local sales-taxes. This means the total sales-tax you pay can depend on where you make your purchase.

- Use Tax: If you buy goods from outside your state and don’t pay sales-tax, you may be required to pay use tax when the goods are brought into your state. This is designed to prevent people from avoiding sales tax by purchasing items from states with lower tax rates.

How to Calculate Sales Tax

Sales tax is calculated by applying the appropriate sales tax rate to the price of the product or service being purchased. The formula is straightforward:

Sales Tax = Price of the Item × Sales Tax Rate

Example Calculation:

Let’s say you’re buying a pair of shoes that cost $100, and the sales-tax rate in your area is 8%. To calculate the sales tax, you multiply the price by the sales-tax rate:

Sales Tax = $100 × 0.08 = $8

The total price of the shoes, including tax, would be:

Total Price = Price of the Item + Sales Tax = $100 + $8 = $108

Steps to Calculate Sales Tax

- Determine the Price of the Item: This is the base price before any taxes are applied.

- Find the Applicable Sales Tax Rate: This can usually be found through your state or local government website. Be sure to account for any additional local taxes.

- Multiply the Price by the Sales Tax Rate: Multiply the base price of the item by the sales-tax rate to calculate the amount of tax due.

- Add the sales tax to the price of the item: The sum will give you the total cost of the item, including sales-tax.

How is an excise tax different from a sales tax?

Both excise taxes and sales-taxes are forms of taxation that are applied to goods and services, but they have some key differences. Understanding these differences can help businesses and consumers navigate their financial responsibilities more effectively.

Sales Tax

As mentioned earlier, sales-tax is a tax levied on the sale of goods and services to consumers. It is typically added to the sales price at the point of sale, and the buyer is responsible for paying it. Sales tax is generally applied to a broad range of items, including food, clothing, and electronics.

Excise Tax

An excise tax is a specific tax on certain goods or activities, often levied on the manufacturer or producer rather than the consumer. These taxes are typically applied to items that are considered non-essential or that have externalities, such as alcohol, tobacco, gasoline, and luxury goods.

Excise taxes can be categorized into two types:

- Excise Taxes on Goods: These are applied to specific items, like cigarettes or alcohol. The excise tax is usually included in the price, and the consumer pays it indirectly when purchasing the item.

- Excise Taxes on Activities: These taxes are levied on certain activities such as air travel (taxes on airline tickets), or carbon emissions (environmental taxes). In this case, the business conducting the activity typically pays the tax but may pass the cost on to the consumer.

Key Differences Between Sales-Tax and Excise Tax:

- Targeted goods vs. general goods:

- Sales tax applies to a broad range of goods and services.

- Excise tax applies specifically to certain goods like tobacco, alcohol, and gasoline.

- Who Pays the Tax:

- Sales-tax is collected directly from the consumer at the time of purchase.

- Excise tax is often collected from the manufacturer or producer, but the cost is typically passed on to the consumer.

- Calculation:

- Sales-tax is calculated as a percentage of the price of the item.

- Excise tax is often a fixed amount per unit (e.g., per gallon of gasoline or pack of cigarettes).

- Revenue Use:

- Revenue from sales-tax is typically used to fund general state or local services.

- Excise taxes are often earmarked for specific purposes, such as funding road construction (for gasoline taxes) or public health programs (for tobacco taxes).

Example:

- Sales Tax: You buy a $100 jacket and pay 8% sales tax. The tax is $8, and the total cost is $108.

- Excise Tax: You buy a pack of cigarettes for $10, and the excise tax maybe $2 per pack. You pay $12, but the $2 is an excise tax added to the price of the cigarettes, which the manufacturer pays to the government.

NYC Sales Tax

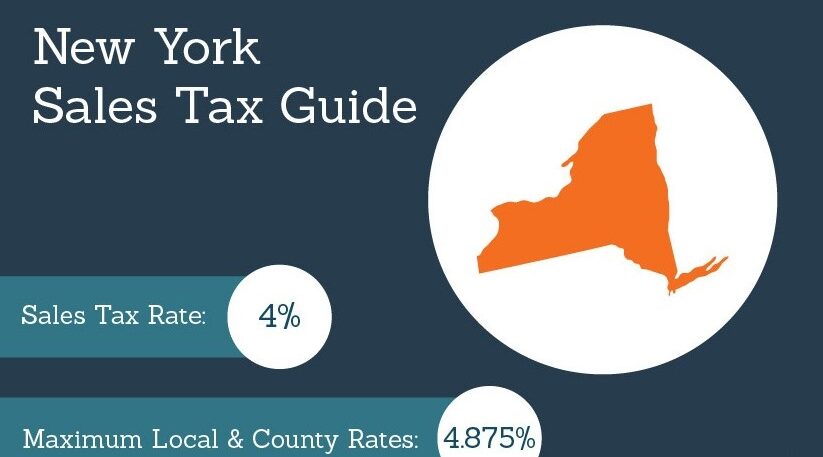

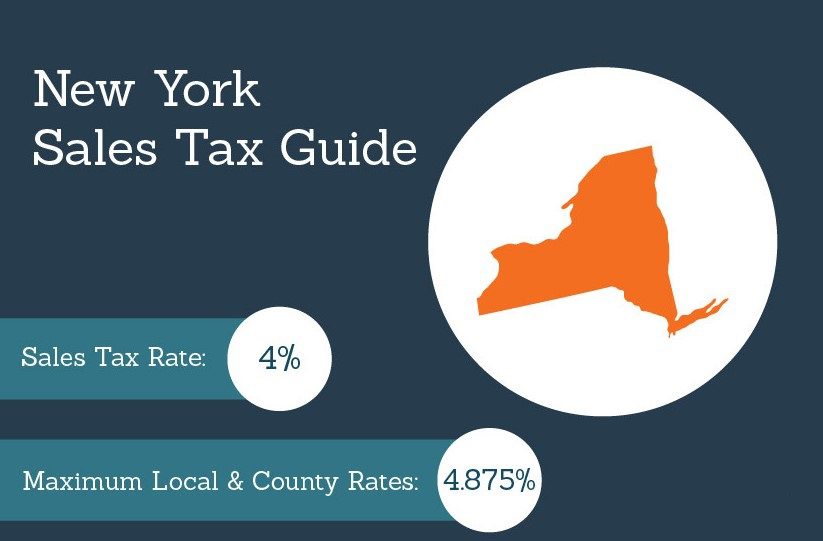

New York City has its sales-tax system, which includes state-level taxes, as well as local taxes. Here’s an in-depth look at how sales-tax works in New York City:

Sales-Tax Rate in NYC

As of 2025, the total sales tax rate in New York City is 8.875%, which is made up of:

- New York State Sales-Tax: 4%

- New York City Sales-Tax: 4.5%

- Metropolitan Commuter Transportation District (MCTD) Tax: 0.375%

What Is Taxed in NYC?

New York City imposes sales-tax on most tangible goods, as well as certain services. However, some items and services are exempt from sales-tax.

Taxable Items:

- Clothing and footwear (with some exceptions; clothing items under $110 are exempt from sales-tax)

- Furniture, electronics, and household goods

- Certain prepared foods, such as takeout meals

- Admission to places of amusement, such as museums and theaters

Exempt Items:

- Food purchased for home consumption (with some exceptions)

- Prescription medicine and medical devices

- Certain educational materials

How NYC Sales Tax Affects Businesses

If you’re a business operating in New York City, it’s essential to collect sales-tax from your customers on f. Businesses must also remit the sales-tax to the state’s Department of Taxation and Finance. The process of collecting, reporting, and paying sales-tax is known as sales-tax compliance.

Steps for Sales Tax Compliance in NYC:

- Register with the State: Businesses must first register for a sales-tax permit with the New York State Department of Taxation and Finance.

- Collect Sales Tax: Businesses must collect the appropriate amount of sales-tax at the point of sale.

- Remit Sales Tax: Businesses must file regular sales-tax returns and remit the collected taxes to the state.

- Keep Records: Businesses need to keep accurate records of all sales and sales-tax collected.

Special Cases in NYC Sales Tax

- Clothing Exemption: In NYC, clothing items under $110 are exempt from sales-tax. This provides a tax break to consumers on necessary clothing purchases.

- Restaurant and Catering Services: In New York City, meals prepared for immediate consumption (e.g., in a restaurant or for catering) are subject to sales tax. However, food sold for home consumption may be exempt from sales tax.

- Online Sales and the Marketplace Facilitator Law: If your business sells goods online and has a significant presence in NYC, you must collect sales-tax on sales to customers in NYC. This includes sales made through online marketplaces like Amazon and eBay, as New York’s Marketplace Facilitator Law requires these platforms to collect and remit the sales-tax.

Example Calculation for NYC:

If you buy a $100 item in New York City, the sales-tax would be calculated as:

Sales–Tax = $100 × 0.08875 = $8.875

Thus, the total cost of the item would be:

Total Cost = $100 + $8.875 = $108.875

Conclusion

Sales-tax is an essential aspect of doing business, both for consumers and businesses. It serves as a primary source of revenue for governments and plays a significant role in how goods and services are priced. Understanding how sales-tax works, how to calculate it, and the differences between it and excise tax is crucial for both consumers and business owners.

For businesses in New York City, it’s essential to stay compliant with local and state sales-tax regulations to avoid penalties and ensure smooth operations. Whether you’re a consumer trying to understand how much tax you’ll pay on a purchase or a business navigating your sales-tax obligations, the key is to stay informed and proactive.

At Syed Professional Services, we specialize in providing expert guidance on tax compliance, helping businesses thrive in complex regulatory environments. If you need assistance with your sales tax or any other financial services, feel free to reach out to us for personalized support tailored to your needs.