Introduction

When it comes to taxes, navigating the system’s complexities can be daunting, especially when dealing with state-specific nuances. If you’re a resident or business owner in New York, understanding NY state tax laws is crucial. Fortunately, Syed Professional Services is here to assist you with all your state tax services needs, from filing your taxes to maximizing your state tax refund. Whether dealing with personal taxes or business-related issues. Syed Professional Services provides expert guidance that can save you time, stress, and money.

Understanding NY State Tax

New York state tax can be overwhelming for both individuals and businesses, as it involves various rates, exemptions, and credits. As a state that collects both personal income taxes and business taxes, New York has one of the most complex tax systems in the country. The state’s income tax rates vary based on income brackets, and there are also additional taxes for certain regions like New York City and Yonkers.

Types of State Taxes in New York

The New York state tax system includes several different types of taxes that individuals and businesses must pay. These include:

- Personal Income Tax: New York has a progressive income tax, meaning the more you earn, the higher your tax rate. This income tax is applied to your federal adjusted gross income, with deductions for various exemptions.

- Corporate Franchise Tax:. Businesses in New York state are required to pay this tax, which is based on their gross income or a percentage of their total assets.

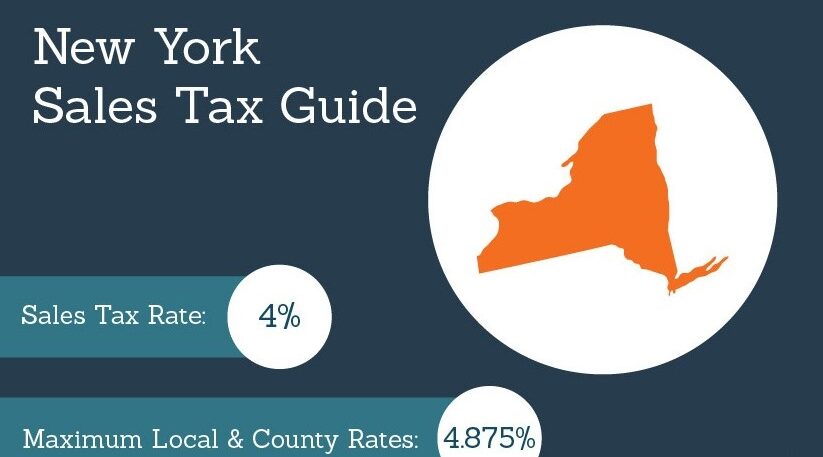

- Sales Tax: Sales tax is collected on the sale of tangible personal property and certain services within the state.

- Property Taxes: Homeowners and property owners in New York are subject to property taxes levied by local municipalities.

- Estate Tax: The estate tax applies to the estates of individuals who pass away with property located in New York.

Why Understanding NY State Tax is Crucial

Understanding the ins and outs of New York state tax is crucial for minimizing your liabilities and maximizing potential refunds. The state’s tax rates can be high, especially for high earners or individuals living in specific areas like New York City. Having a clear understanding of the different deductions, exemptions, and credits available can significantly reduce the amount you owe. Moreover, for businesses, understanding New York’s corporate tax structure ensures that you comply with regulations and avoid penalties. Since New York offers various tax incentives for businesses that operate within the state. It’s essential to take full advantage of these benefits.

Maximizing Your NY State Tax Refund

One of the most critical aspects of dealing with NY state taxes is the potential for a refund. New York state residents who overpay their taxes during the year can receive a refund when they file their returns. There are several ways to maximize your refund, and Syed Professional Services is here to help you with strategies such as:

- Claiming Deductions and Credits: New York state offers several credits and deductions that can reduce your taxable income. Some of the most common ones include the standard deduction, itemized deductions, and credits for low-income earners.

- Reviewing Your Withholding:. If too much was withheld from your paycheck throughout the year, you could be entitled to a refund. Adjusting your withholding amounts for the future could help maximize your refund in the upcoming tax year.

- Timely Filing:. Filing your taxes early not only helps avoid penalties but also speeds up the process of receiving your state tax refund.

- Itemized Deductions:. Depending on your situation, you may benefit from itemizing your deductions. Especially if you have significant medical expenses, mortgage interest, or charitable contributions.

How Syed Professional Services Can Help You with NY State Tax

Navigating the complexities of New York state tax laws can be challenging. This is why Syed Professional Services is committed to offering you expert assistance. Here’s how our team of professionals can make the process easier for you:

- Tax Filing Assistance: We ensure your tax returns are filed correctly and on time. Our team will assist you in determining the most beneficial filing status, deductions, and credits for your situation.

- Refund Optimization:. We work with you to ensure that you claim every deduction and credit available to you, maximizing your state tax refund.

- Personalized Guidance:. Whether you’re filing taxes for the first time or are a seasoned tax filer. Our professionals will guide you through every step of the process, answering any questions you may have along the way.

- State-Specific Advice: New York state has unique rules and regulations. Syed Professional Services provides expert advice on the specific tax laws that apply to you based on your location, income, and business type.

Common Questions About NY State Tax and Refund

- What is the deadline for filing NY state taxes?

- The deadline for filing your New York state taxes is typically April 15th. However, this may vary if the due date falls on a weekend or holiday.

- How can I check the status of my NY state tax refund?

- You can check the status of your refund by visiting the New York State Department of Taxation and Finance website and using their “Where’s My Refund?” tool.

- Can I file my New York state taxes online?

- Yes, New York state taxes can be filed online through the New York State Department of Taxation and Finance website or through third-party tax filing services.

- What is the New York state income tax rate?

- New York state income tax rates are progressive, with rates ranging from 4% to 8.82% based on your income bracket.

- What deductions are available for New York state taxes?

- Some common deductions for New York state taxes include the standard deduction, medical expenses, mortgage interest, and property tax deductions.

- How long does it take to receive my NY state tax refund?

- If you file electronically, you may receive your refund within 2-3 weeks. Paper filings can take longer.

Conclusion

Managing your NY state tax responsibilities doesn’t have to be overwhelming. With the expert services of Syed Professional Services. You can ensure that your taxes are filed correctly and that you maximize your tax refund. From individual to business tax needs, we provide comprehensive services that take the stress out of filing. Don’t let the complexities of state tax laws slow you down. Contact Syed Professional Services today and get the expert help you need to stay on top of your state tax obligations!

Understanding NY State Tax Rates and How They Impact Your Finances

New York’s state tax rates are structured progressively. Meaning that as your income increases, the percentage of tax you owe also increases. These rates apply to your taxable income, and it’s important to know where you stand on the tax bracket. Here’s a breakdown of how the tax rates work and what they mean for you:

- Tax Brackets:. For individual income tax, New York’s tax brackets start at 4% for lower earners and gradually increase, peaking at 8.82% for higher income earners. Understanding which bracket you fall into can help you plan your financial year better and may also help you anticipate how much you owe come tax time.

- Additional Local Taxes: If you live in New York City or Yonkers, you may also face additional local income taxes. These taxes are separate from state taxes and are calculated on top of your regular New York state tax liability.

- Income Adjustments and Exemptions: There are various income adjustments and exemptions available to reduce your taxable income. For instance, single filers and married couples filing jointly have different standard deductions. Moreover, credits like the Earned Income Tax Credit (EITC) can significantly reduce what you owe or increase your refund.

Common Tax Deductions and Credits in New York State

Maximizing deductions and credits is one of the most effective ways to reduce your taxable income and ultimately lower your state tax liability. Let’s dive into some of the most commonly used tax deductions and credits available for New York state taxpayers:

State-Specific Deductions

- Standard Deduction: For 2025, New York offers a standard deduction that can significantly reduce your taxable income. The amount of the standard deduction depends on your filing status (single, married, etc.). If your eligible deductions are not higher than the standard deduction, this is often the best route to take.

- Itemized Deductions: If you have significant expenses, it might be worth itemizing your deductions instead of taking the standard deduction. Some common items you can deduct include mortgage interest, medical expenses that exceed a certain percentage of your income, and charitable donations.

- New York City School Tax Credit:. For those living in New York City, you can claim a credit on your taxes if you are subject to the city’s school taxes. This is a special credit that reduces your overall state tax liability.

- Property Tax Deduction:. Homeowners in New York can take advantage of a property tax deduction, allowing them to deduct part of their property taxes paid on their primary residence.

Popular State Tax Credits

- Earned Income Tax Credit (EITC): This credit is designed to benefit low to moderate-income workers. If you qualify, it can reduce the amount of state taxes you owe or even provide a refund.

- Child and Dependent Care Credit:. New York offers a credit for families that incur costs for the care of children or dependents while they work. This can be an essential credit for parents and guardians.

- College Tuition Credit:. New York residents who paid qualified tuition expenses at a college or university may be eligible for a tax credit to help offset educational costs.

- Real Property Tax Relief Credit:. This credit, also known as the “School Tax Relief” (STAR) program, helps eligible homeowners reduce the school property taxes they pay.

How Syed Professional Services Can Help You Optimize Your NY State Tax Filing

Tax filing isn’t a one-size-fits-all task, especially when it comes to New York state taxes. With various deductions and credits available, making sure you don’t miss out on opportunities to lower your tax bill is where Syed Professional Services can help you shine. Here’s how we ensure that you benefit fully from your NY state tax filing:

Comprehensive Tax Filing

Our team doesn’t just file your taxes. We look at your entire financial situation and work with you to ensure that you are maximizing deductions, credits, and refund opportunities. Whether it’s identifying specific deductions you might qualify for. Helping you adjust your withholding, or providing advice on the best filing strategies. Syed Professional Services ensures you’re getting the best possible outcome.

Tax Planning and Strategy

Tax planning is an important part of any financial strategy. At Syed Professional Services, we help you plan for future tax years. Especially if you anticipate major changes such as a salary increase, starting a business, or other life events that might impact your tax situation. We’ll help you adjust your tax withholding, and take advantage of retirement accounts that offer tax benefits. And strategize ways to keep your tax liability low for years to come.

Personalized Tax Solutions for Businesses

For business owners. New York state tax obligations can be especially complicated, with corporate taxes, sales taxes, and various other local taxes to consider. Our experts at Syed Professional Services work with business owners to ensure that all corporate tax filings are up to date. That any eligible credits are claimed, and that your business structure is optimized for the lowest possible tax liabilities.

Avoiding Common Tax Filing Mistakes

Tax filing can often come with small errors that lead to audits or fines down the road. Syed Professional Services helps you avoid common mistakes such as missed deductions, incorrect filing statuses, and failure to report income properly. We ensure that your tax return is thorough, accurate, and filed on time.

Key Takeaways for NY State Tax Filers

When filing your taxes in New York, it’s crucial to:

- Understand Your Tax Bracket: New York’s progressive tax rates mean that your income bracket determines how much tax you’ll owe. Be sure you understand where you fall to plan accordingly.

- Maximize Deductions and Credits:. Take advantage of the deductions and credits available to you, such as the Earned Income Tax Credit, property tax deductions, and others that can reduce your overall tax liability.

- File on Time:. Avoid penalties and interest by filing your taxes on time, and make sure to apply for any extensions if needed.

- Get Professional Help:. Navigating New York’s tax laws can be tricky, and Syed Professional Services is here to ensure you don’t miss out on opportunities to reduce your tax burden.

By working with Syed Professional Services.

You can ensure that your tax filings are accurate, efficient, and optimized for the best refund possible. Whether you’re an individual or a business owner, our team is here to provide personalized, expert guidance every step of the way.

Conclusion

Dealing with NY state taxes doesn’t have to be a stressful or confusing experience. With the right expert guidance and a solid understanding of the various tax laws, you can significantly reduce your liability and potentially increase your state tax refund. Let Syed Professional Services be your trusted partner in navigating these complexities, ensuring that you’re always ahead of the game.

Whether you need help filing your taxes, maximizing your refund, or ensuring compliance with New York state tax laws, we’ve got you covered. Contact Syed Professional Services today for tailored tax assistance and peace of mind.

Effective Tax Planning with Syed Professional Services

Tax planning is a vital component of managing your finances, whether you’re an individual filer or a business owner. It’s not just about filing taxes on time but also ensuring you’re optimizing your tax situation to minimize liabilities and maximize returns in the long run. Here’s how Syed Professional Services can help you with tax planning:

Long-Term Tax Strategy Development

When you plan, you ensure that you aren’t scrambling when tax season comes around. Syed Professional Services helps you develop a long-term tax strategy based on your current income, future projections, and specific financial goals. We help you anticipate tax brackets, deductions, and changes in your financial situation—whether that’s a salary increase, starting a new business, or making a significant life change, like marriage or purchasing a home.

With proper planning, we ensure you’re paying as little as possible in taxes throughout the year while maximizing your deductions. We also help you adjust your withholdings so you don’t overpay and end up waiting for a refund that could’ve been used sooner.

Optimizing Retirement Contributions

Retirement accounts like IRAs (Individual Retirement Accounts) and 401(k) plans aren’t just important for saving for your future—they can also provide valuable tax breaks. Contributing to these accounts can reduce your taxable income, helping you pay less in taxes both now and in retirement.

Syed Professional Services works with clients to evaluate their retirement contributions, advising on the most tax-efficient ways to save. For example, Roth IRAs may be advantageous in certain tax situations, as they allow for tax-free withdrawals in retirement, while traditional IRAs provide immediate tax deductions.

Tax-Efficient Investment Strategies

Investing can lead to taxable events like capital gains, dividends, or interest, and these taxes can quickly add up if you’re not strategic about your investment choices. By taking advantage of tax-advantaged accounts, such as retirement accounts, and by leveraging strategies like tax-loss harvesting, Syed Professional Services can help you reduce your overall tax liability from investments.

We provide personalized recommendations to optimize your portfolio based on your current and projected income, ensuring that you are minimizing taxable events and potentially avoiding costly penalties.

Navigating State Tax Refunds in New York: What You Need to Know

One of the most common questions we get from clients is how to ensure they receive the largest possible state tax refund. A refund may seem like a sign of success, but it often means you overpaid your taxes throughout the year. Ideally, you want to balance your tax withholding to get as close as possible to breaking even.

However, if you’ve overpaid and are entitled to a refund, Syed Professional Services can help you:

Understanding Refund Status and Timing

It’s important to know the typical timeline for receiving your refund. The New York State Department of Taxation and Finance typically processes electronically filed returns within 2-3 weeks, while paper returns may take longer. If you’ve filed your taxes and want to track your refund status, we provide guidance on how to check the status online.

Additionally, if there are any delays, we can assist you in resolving issues that may have arisen, such as errors on your return or missing information. Our goal is to get your refund processed as quickly as possible.

Maximizing Your State Tax Refund

The best way to ensure you’re getting the maximum refund possible is by claiming every deduction and credit available to you. Syed Professional Services helps clients ensure they don’t miss out on valuable opportunities. Here are a few key strategies we use to maximize your refund:

- Reviewing Tax Withholdings:. If you’re receiving a large refund, it may mean you’re having too much withheld from your paycheck throughout the year. We’ll help you adjust your withholdings so you can use that money in real time instead of waiting for it to be refunded later.

- Ensuring Credit Eligibility: New York offers a range of tax credits that reduce your tax liability. Whether it’s the Earned Income Tax Credit or the Child and Dependent Care Credit, we’ll make sure you qualify for and claim all available credits.

- Itemizing vs. Standard Deduction: For some taxpayers, itemizing deductions can lead to a larger refund. We’ll walk you through the process to ensure you’re using the most beneficial option for your tax situation.

- Filing Early: The sooner you file, the sooner you’ll receive your refund. Syed Professional Services ensures that your return is filed promptly and correctly to avoid delays.

State Tax Services for Businesses in New York

Business owners face additional complexities when it comes to state taxes, especially in New York. Whether you’re a small business or a large corporation, Syed Professional Services can help with tax planning, preparation, and compliance.

Corporate Franchise Tax for Businesses

New York’s corporate franchise tax applies to most businesses that operate within the state. This tax is based on your company’s gross income or assets, and understanding how to minimize it can save your business a significant amount each year.

We guide business owners in structuring their business in a way that reduces the tax burden, offering strategies like choosing the right type of business entity (LLC, S-Corp, etc.) to optimize tax obligations.

Sales Tax Compliance

If your business sells goods or services, you are likely required to collect sales tax from customers. Syed Professional Services can help you navigate New York’s sales tax laws and ensure your business is in full compliance. From registering for a sales tax permit to filing sales tax returns, we handle all the complexities of sales tax for you.

Employee Tax Withholding

If you have employees, you must be withholding the correct amount of taxes from their wages. We provide payroll tax services to ensure that you’re withholding state income taxes correctly, as well as helping you with other employer obligations, such as unemployment insurance and disability benefits.

Tax Credits for Businesses

New York offers several tax credits for businesses, such as the Excelsior Jobs Program, which encourages job creation and investment in specific industries. Our team helps businesses identify and apply for these credits, reducing your overall tax liability and potentially offering additional financial incentives.

Final Thoughts on Navigating NY State Taxes

Taxes are a significant part of any financial situation, whether you’re an individual or a business owner. Understanding New York state taxes, including how to file, claim deductions, and maximize your refund, is essential for making the most of your financial year. With Syed Professional Services by your side, you can rest assured that you’re taking the right steps to optimize your state tax situation.

Don’t let the complexities of New York state tax laws overwhelm you—whether it’s filing your taxes, maximizing deductions, or planning for the future, Syed Professional Services is here to provide expert guidance. Reach out today to start optimizing your NY state taxes!