When starting a nonprofit organization, one of the most crucial forms you’ll need to file is IRS Form 1023. Filing this form is essential for obtaining 501(c)(3) tax-exempt status, which is crucial for any nonprofit that wants to qualify for federal tax exemptions and receive charitable donations, allowing donors to claim tax deductions. In this post, we’ll break down what IRS Form 1023 is, how to fill it out, and the filing fees associated with it. Other key details to help you navigate the process smoothly.

What is IRS Form 1023?

Nonprofit organizations use IRS Form 1023 to apply for recognition as a tax-exempt entity under Section 501(c)(3) of the Internal Revenue Code. This form lets the IRS know that your organization qualifies as a charitable entity and will operate exclusively for religious, charitable, scientific, educational, literary, or other purposes recognized as tax-exempt.

When you file IRS Form 1023, you’re providing the IRS with detailed information about your nonprofit’s structure, operations, governance, and financials. The form is used to determine if your organization meets the requirements for tax-exempt status.

The Importance of Form 1023 for Nonprofits

For a nonprofit to thrive, it must be able to accept tax-deductible donations and apply for various grants. Filing Form is the first step in securing tax-exempt status. Which not only reduces your organization’s liability but also helps build trust and credibility with donors and partners. Without this filing, your organization won’t be eligible for many funding opportunities or benefits tied to tax-exempt status.

Understanding the Form 1023 Filing Fee

One of the important aspects of filing IRS Form 1023 is understanding the filing fee. The fee varies depending on the form you are submitting and the size of your organization.

Standard Filing Fee:

For most applicants, the filing fee for IRS Form 1023 is $600. This fee is non-refundable and must be paid at the time of filing.

Streamlined Application:

If your nonprofit is eligible to file a streamlined version of the form (called Form 1023-EZ), the filing fee is lower, at $275. To qualify for the streamlined process. Your organization must meet certain criteria, such as having projected gross receipts of $50,000 or less in the next 3 years and assets under $250,000.

Form 1023 Instructions: A Step-by-Step Guide

Filling out Form can be a complicated process, and it’s essential to follow the Form 1023 instructions carefully to avoid mistakes that might delay your approval. Here’s an overview of the main sections you’ll need to complete.

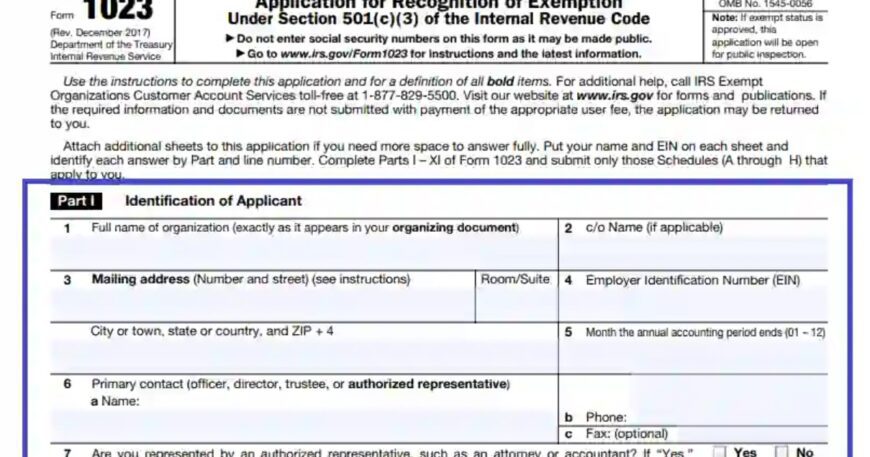

1. Part I—Identification of Applicant:

This section asks for basic information about your nonprofit organization. Such as its legal name, address, and type of organization it is (i.e., public charity, private foundation, etc.).

2. Part II: Organizational Structure:

You’ll be required to provide a detailed description of your organization’s structure, including its bylaws, articles of incorporation, and governing body. This is crucial because the IRS wants to ensure your organization is properly set up to operate for exempt purposes.

3. Part III: Required Provisions in Your Organizing Document:

This section checks if your organizing documents (articles of incorporation) include the necessary language, like restrictions on activities and dissolution clauses, to qualify for tax-exempt status.

4. Part IV: Narrative Description of Activities:

One of the most critical parts of the application. This section requires you to describe your nonprofit’s activities, explaining in detail how it will fulfill its charitable purpose. The IRS is looking for a clear connection between your mission and the activities you will conduct.

5. Part V: Compensation and Financials:

This part asks about compensation for your directors, officers, and key employees, as well as financial statements. It’s vital to show transparency and that your nonprofit won’t be benefiting private interests.

6. Part VI: Your Public Charity Status:

This section is where you explain whether your organization qualifies as a public charity or a private foundation. A public charity generally has a broader public support base, while a private foundation usually relies on a single source of funding.

7. Part VII: Financial Data:

The IRS will want to see projections of your nonprofit’s future finances, including detailed statements about revenue, expenses, and other key financial figures.

Tips for Successful Form 1023 Filing

- Be Thorough and Accurate: Ensure that all sections of the form are completed in detail. Incomplete or inaccurate information can lead to delays or even denials.

- Understand IRS Requirements:. Take the time to read and understand IRS guidelines on 501(c)(3) status to make sure your nonprofit qualifies.

- Get Professional Help: Consider working with a professional service that specializes in nonprofit filings, like Syed Professional Services. Their team can guide you through the process and help you avoid common mistakes.

- Keep Records Organized: Proper documentation will make the filing process smoother and ensure that your financials are in order.

How Long Does It Take for Form 1023 Approval?

The approval process for Form 1023 can take anywhere from 3 to 12 months, depending on various factors, including the complexity of your organization and the volume of applications the IRS is processing at the time. If you’re applying for Form 1023-EZ, the process might be quicker, often taking as little as 2-4 weeks.

What Happens After Filing Form 1023?

Once you’ve submitted your Form, the IRS will review your application and either approve or deny your request for tax-exempt status. If they approve it, they’ll send you an official letter stating that your nonprofit is now recognized as a 501(c)(3) organization.

If your application is denied, you’ll receive a letter explaining why, and you may have the option to appeal the decision or make corrections and reapply.

Frequently Asked Questions About IRS Form 1023

What is the difference between Form 1023 and 1023-EZ?

Form 1023 is a comprehensive application for tax-exempt status, whereas Form 1023-EZ is a simplified version for smaller organizations that meet certain criteria.

Can I submit Form 1023 online?

Yes, the IRS allows you to submit this form electronically via its website, which can speed up the application process.

What happens if I don’t file Form 1023 for my nonprofit?

If you don’t file Form 1023, your organization will not be recognized as tax-exempt and will be subject to federal taxes. You also won’t be able to accept tax-deductible donations.

Can I file Form 1023 before starting activities?

Yes, you can file this form before your nonprofit officially begins its activities, but you must show that the planned activities will be consistent with the 501(c)(3) requirements.

How do I know if my nonprofit is eligible for Form 1023-EZ?

You must meet specific eligibility requirements, such as having less than $50,000 in projected annual gross receipts and assets under $250,000.

Is there any way to expedite the Form 1023 process?

Unfortunately, there is no official way to expedite the approval process, but filing electronically may speed things up slightly.

Conclusion: Navigating the IRS Form 1023 Process with Confidence

Navigating the process of filing IRS Form 1023 doesn’t have to be daunting. With careful attention to detail, understanding the instructions, and staying organized, you can successfully apply for tax-exempt status. Don’t hesitate to reach out to Syed Professional Services for expert assistance in completing your form, ensuring that your nonprofit is on the path to success.

By properly submitting Form 1023, you’ll open up a world of opportunities for your nonprofit, from tax savings to gaining access to grants and donations that will help your mission thrive.