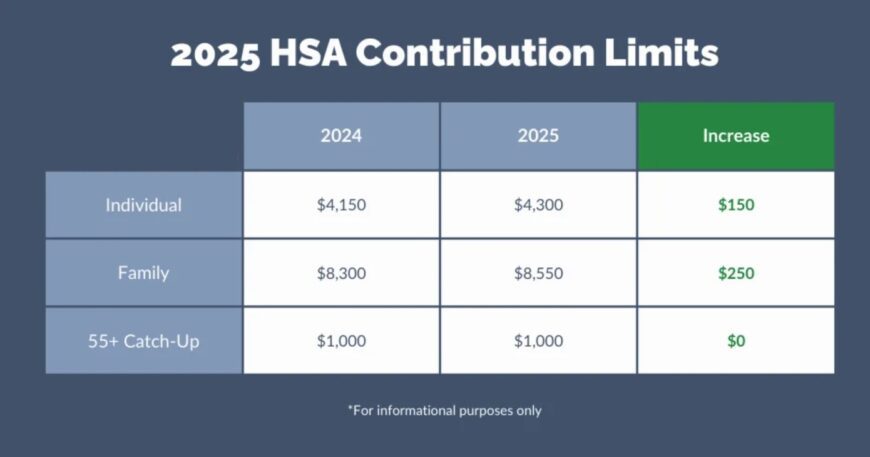

Your Complete Guide to HSA Contribution Limits for 2023, 2024, and 2025

Health Savings Accounts (HSAs) are powerful tools for managing healthcare expenses while enjoying significant tax benefits. Understanding HSA contribution limits is critical to maximizing these accounts and ensuring compliance with IRS regulations. Each year, the IRS adjusts these limits to account for inflation and changes in the healthcare landscape. Syed Professional Services can assist you […]