Health Savings Accounts (HSAs) are powerful tools for managing healthcare expenses while enjoying significant tax benefits. Understanding HSA contribution limits is critical to maximizing these accounts and ensuring compliance with IRS regulations. Each year, the IRS adjusts these limits to account for inflation and changes in the healthcare landscape.

Syed Professional Services can assist you and your business navigate HSA rules and contribution limits to maximize this tax-advantaged savings tool. This blog will provide a comprehensive overview of HSA usage limits for 2023, 2024, and 2025 and information on how these accounts function and their advantages.

What is an HSA contribution limit?

The HSA contribution limit refers to how much each family and individual can contribute yearly to their health savings accounts. The amount is adjusted annually by the IRS for inflation. Maintaining these limits is essential to keeping your tax-advantaged status for an HSA.

How do HSA contribution limits matter?

Tax Advantages: Contributions are tax-deductible, reducing your taxable income.

Healthcare Savings: Funds can be used for qualified medical expenses tax-free.

Penalty Avoidance: Overcontributing can lead to penalties and excess taxes.

HSAs are only available to individuals enrolled in a high-deductible health plan (HDHP), making them a popular choice for people who want to balance healthcare costs with long-term savings.

HSA Contribution Limits for 2023

Key Highlights for 2023:

These limits increased from 2022 for inflation-based adjustments.

Individuals aged 55 or older can contribute an additional $1,000, called the catch-up contribution, to increase their savings.

Contributions may be made by account holders, employers, or both.

HSA Contribution Limits for 2What’sat’s in2Win2What’sat’s individual and family coverage increased dramatically to keep pace with the increasing cost of healthcare.

This rise enables HSA participants to save even more for future medical expenses.

You need to make contributions before the tax filing deadline (April 15, 2025) for them to count toward the 2024 tax year

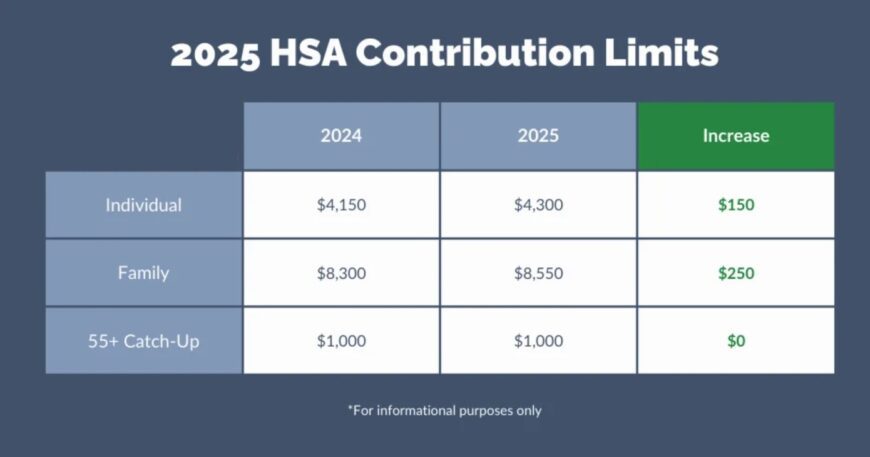

HSA Contribution Limits for 2025 (Projected)

What to expect in 2025

Healthcare savings continue to grow. Limits will allow individuals and their families to make more considerable healthcare savings.

Inflation adjustments will likely remain consistent with past trends, making HSAs an even more attractive option for managing healthcare costs.

How to Maximize HSA Contributions

Maximizing your HSA contributions requires careful planning and an understanding of IRS rules to get the most out of your HSA.

1. Contribute the Maximum Amount

Aim to contribute the full allowable limit each year to maximize your tax benefits and grow your healthcare savings.

2. Take Advantage of Employer Contributions

If your employer offers to contribute to your HSA, take full advantage of this benefit. Employer contributions count toward your annual limit, so plan accordingly.

3. Use Catch-Up Contributions. If you’re older, forget to add an extra $1,000 catch-up contribution to boost your savings.

4. Invest Your HSA Funds

Many HSA providers allow you to invest funds in mutual funds or other investment options. Investing can help your HSA grow over time, turning it into a powerful retirement savings tool.

5. Monitor Your Contributions

Keep track of all contributions to avoid exceeding the annual limit. Overcontributions can result in a 6% excise tax on the excess amount.

The Benefits of an HSA

An HSA comes with many advantages for individuals as well as for families:

Triple Tax Advantage: Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free.

Portability: Your HSA belongs to you, not your employer, so it is available no matter where your career takes you.

Flexibility: Funds may be used to pay for many different qualified medical expenses, such as doctor visits, prescriptions, and even some over-the-counter medications.

Long-term Savings: All unspent amounts automatically roll over into subsequent years, making HSAs one of the most efficient ways to save for retirement.

HSA Contribution Limit Frequently Asked Questions

What will happen if I over-contribute to my HSA?

Excess contributions you make attract a 6 percent excise tax annually for all years they exist in the HSA. Remove the excess HSA contributions to your HSA account before submitting your tax returns to avoid any issues.

Can I contribute to an HSAI? I’m no longer enrenroI’md an HDHP.

You can only contribute to an HSA while a qualifying high-deductible health plan covers you. However, you can still use your existing HSA funds for qualified medical expenses.

Are employer contributions included in the HSA contribution limit?

Yes, any contributions made by your employer count toward your annual limit.

Can I use HSA funds for non-medical expenses?

Yes, but non-medical withdrawals are subject to income tax and a 20% penalty if you are 65.

Do HSA contributions reduce my taxable income?

Yes, contributions to your HSA are tax-deductible, lowering your taxable income for the year.

What is the deadline for making HSA contributions?

Contributions for a tax year can be made until the tax filing deadline (typically April 15 of the following year).

How can Syed Professional Services Help?

HSA rules and contribution limits can be complex, but Syed Professional Services is here to simplify it. Our expert team provides:

Personalized guidance: We help you understand your eligibility and maximize your contributions.

Tax Planning Assistance: We ensure your HSA contributions align with your financial and tax strategies.

Compliance Support: Avoid penalties and stay compliant with IRS regulations.

Employer HSA Solutions: We help companies establish and manage HSA programs for their employees.

Whether you are an individual maximizing your HSA or a business offering HSA benefits, Syed Professional Services actively assists you.

Conclusion

Knowing the HSA contribution limits for 2023, 2024, and 2025 is necessary to optimize the tax-benefits savings tool. So, know the IRS limits and take advantage of catch-up contributions and employer benefits to build a robust healthcare savings plan that serves you now and in retirement.

At Syed Professional Services, we pledge to guide you through contributions and compliance. Call intricacies us today to learn how we can help you attain your financial objectives with confidence and peace of mind.