Introduction:

Understanding the Standard deduction 2024 is crucial for every taxpayer when tax season rolls around. The standard deduction is a fixed amount that reduces your taxable income, making it a key factor in determining your tax liability. For the tax years 2024 and 2025, the standard deduction has seen changes that could impact many taxpayers. If you’re wondering, what is the standard deduction for 2024? Or, looking ahead to the 2025 standard deduction, you’ve come to the right place. This blog will explain how these deductions work, who qualifies, and what the future holds for taxpayers.

What is the standard deduction 2024?

The standard deduction is a set amount that taxpayers can subtract from their total income before they are taxed. It’s a way to simplify the tax filing process, offering a flat-rate deduction to individuals and families.

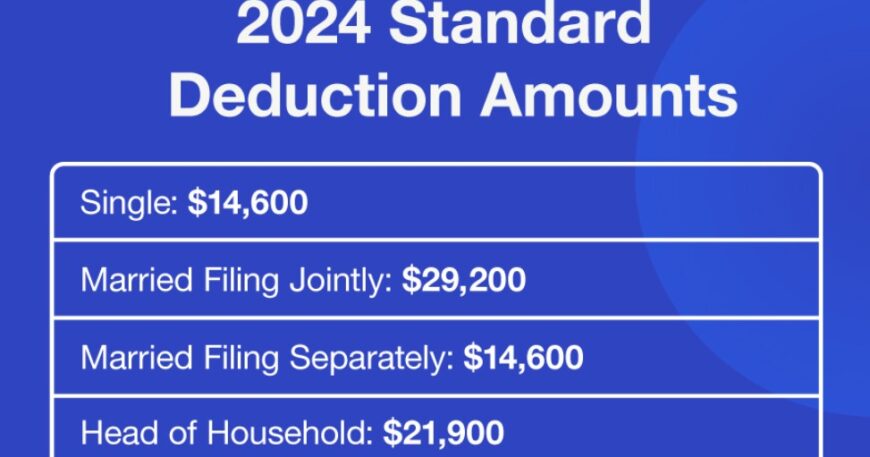

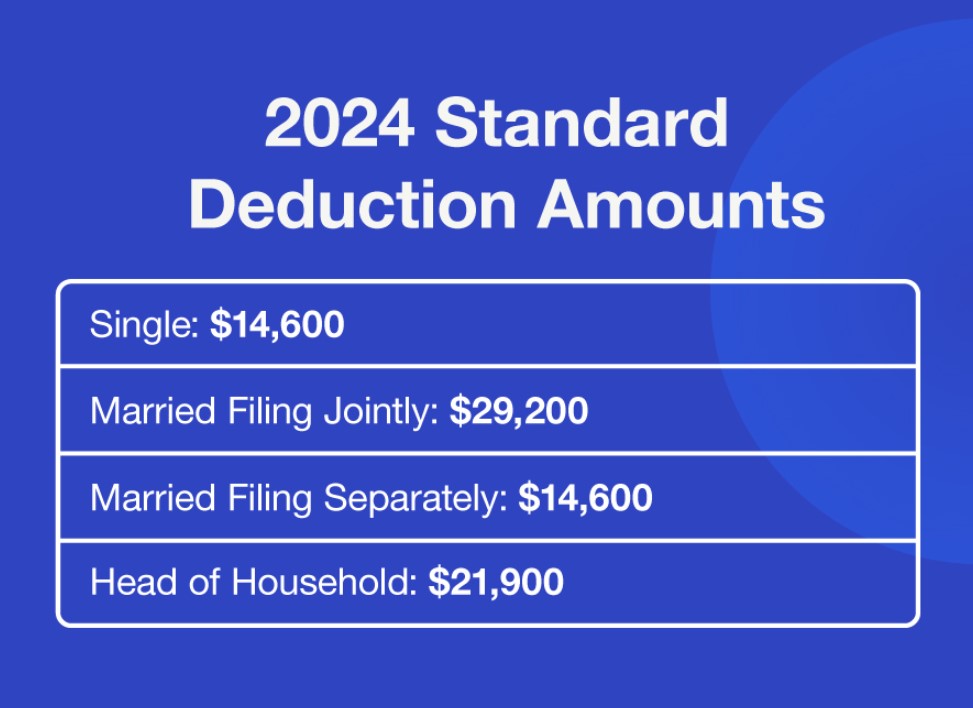

For the tax year 2024, the IRS has adjusted the standard deduction for inflation. The standard deduction for 2024 is

- $27,700 for single filers and married individuals filing separately.

- $55,400 for married couples filing jointly.

- $41,800 for heads of household.

This means that if you qualify for the standard deduction, you can reduce your taxable income by these amounts, which can significantly lower the taxes you owe.

These amounts reflect a significant increase from the previous year, helping taxpayers to keep pace with inflation. But why is it important? By claiming the standard deduction, you can avoid itemizing your deductions, which is time-consuming and complicated. For most taxpayers, the standard deduction is the simpler and more advantageous option.

Changes in the Standard Deduction 2024

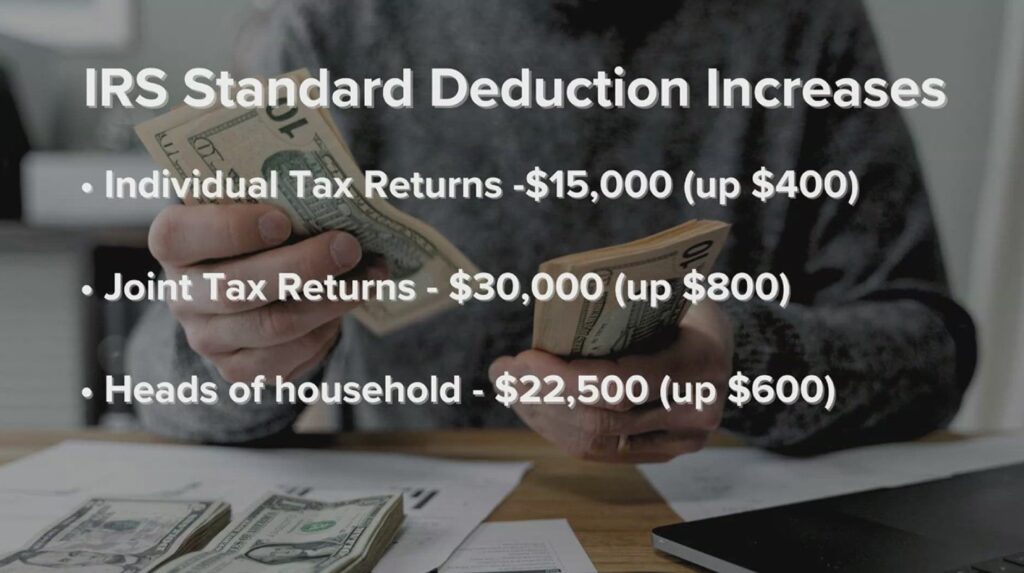

There are notable updates to the standard deduction for 2024 compared to previous years. Each year, the IRS adjusts the amounts based on inflation, and the increase in 2024 reflects rising costs and changes in the economy.

Here’s how it compares to previous years:

- 2023: The standard deduction for single filers was $13,850, and for married couples filing jointly, it was $27,700.

- 2024: The increase is substantial—by $900 for single filers and $1,800 for joint filers.

This increase in the 2024 standard deduction will benefit many taxpayers by lowering their taxable income, which in turn reduces the amount of tax they owe.

Who Qualifies for the Standard Deduction?

Most taxpayers qualify for the standard deduction. However, there are a few exceptions. Here’s who can claim the standard deduction:

- Single Filers: If you file as a single taxpayer and your total income does not exceed the deduction amount, you’re eligible for the standard deduction.

- Married Filing Jointly: Married couples who file together can claim the standard deduction, which is double the amount for single filers.

- Head of Household: If you’re unmarried but support a dependent, you may qualify for the standard deduction for heads of household.

However, some individuals may not be eligible for the standard deduction, including.

- Non-resident aliens: They generally do not qualify for the standard deduction unless they are married to a U.S. citizen or resident alien.

- Married individuals filing separately: If you’re married and choose to file separately, both spouses must either take the standard deduction or itemize. One spouse can’t take the standard deduction while the other itemizes.

How Does the Standard Deduction Impact Your Taxes?

Understanding how the standard deduction affects your taxes can help you make more informed decisions during tax season. When you file your tax return, you’ll subtract your standard deduction from your total income, which lowers your taxable income. The result is that you only pay taxes on the remaining amount, and this reduces your overall tax liability.

For example, if you earn $50,000 as a single filer and take the standard deduction of $27,700 for 2024, your taxable income would be reduced to $22,300. You would only pay taxes on that reduced amount instead of your full income, potentially lowering your tax bill significantly.

What is the standard deduction for 2025?

Looking ahead to 2025, the IRS will likely continue to adjust the standard deduction for inflation. However, specific amounts for the 2025 tax year haven’t been confirmed yet. Based on historical trends, we can expect further increases to help taxpayers keep pace with rising costs.

For 2025, you might see the standard deduction continue to rise modestly to keep up with inflation. While it’s impossible to predict exact numbers, it’s safe to say that the 2025 standard deduction will likely remain one of the easiest ways for taxpayers to reduce their taxable income without having to itemize deductions.

Why Take the Standard Deduction?

Many taxpayers choose the standard deduction because it’s simple. But is it the best option for everyone?

Here’s why most people opt for the standard deduction:

- Simplicity: Unlike itemizing deductions, which requires keeping track of receipts and making detailed calculations, the standard deduction offers a flat-rate reduction.

- Time-saving: You don’t have to spend hours gathering documents and receipts. The standard deduction is easy to calculate.

- No Need for Itemizing: If you don’t have significant deductible expenses (such as mortgage interest or medical expenses), taking the standard deduction is likely the better option.

FAQs About the Standard Deduction for 2024

What is the standard deduction 2024?

The standard deduction for 2024 is $27,700 for single filers, $55,400 for married couples filing jointly, and $41,800 for heads of household.

Can I take the standard deduction if I itemize my deductions?

No, you cannot claim both the standard deduction and itemized deductions. You must choose one or the other.

Is the standard deduction 2024 higher than last year?

Yes, the standard deduction for 2024 is higher than in 2023. It increased to $27,700 for single filers, up from $13,850 in 2023.

Who is eligible for the standard deduction 2024?

Most taxpayers are eligible for the standard deduction, including single filers, married couples filing jointly, and heads of household. However, non-resident aliens and married individuals filing separately may not qualify.

What is the difference between the standard deduction and itemized deductions?

The standard deduction is a fixed amount that reduces your taxable income, while itemized deductions require you to track and report specific expenses such as mortgage interest, charitable donations, and medical costs.

How does the standard deduction affect my tax bill?

The standard deduction reduces your taxable income, which can lower the amount of taxes you owe. For example, if your income is $50,000 and you claim the standard deduction of $27,700, your taxable income is reduced to $22,300.

Conclusion

Understanding the standard deduction 2024 is an essential step in preparing your taxes. With the increase in the deduction amounts, many taxpayers can reduce their taxable income and potentially lower their tax liability. As you prepare for tax season, consider whether the Standard deduction 2024 or itemizing deductions is best for your situation.

Looking ahead, the 2025 standard deduction will likely continue to rise, helping taxpayers navigate the ongoing effects of inflation. By staying informed and understanding how the standard deduction works, you can ensure you’re maximizing your tax savings.