Navigating tax forms can often be confusing, especially when dealing with the complexities of retirement accounts, pension plans, or other types of distributions. One such form you may encounter is 1099-R Form. This document is essential for individuals who have received a distribution from a retirement plan, pension, annuity, or similar arrangement. Whether you’re withdrawing from a 401(k), receiving pension payments, or rolling over funds from an IRA. The 1099-R form is the key to understanding the taxes associated with these transactions.

This blog post will cover all you need to know about 1099-R Form, including its purpose. How to interpret it, and the instructions for calculating the taxable amount. We will also dive deep into the various distribution codes, Box 7 codes, and much more to make sure you’re well-equipped to handle your tax filing.

What is Form 1099-R?

Form 1099-R is a document issued by financial institutions, insurance companies, or pension plans when an individual receives a distribution of $10 or more from a retirement plan. The form reports income received from a variety of sources, including:

- Pensions

- Annuities

- Retirement or profit-sharing plans

- IRAs

- Insurance contracts

Essentially, if you withdraw money from a retirement account. The financial institution handling the account will issue Form 1099-R to both you and the IRS. The form details the total amount distributed to you, any tax withheld, and how the distribution is classified. Understanding Form 1099-R is crucial for ensuring you accurately report these amounts during your tax filing.

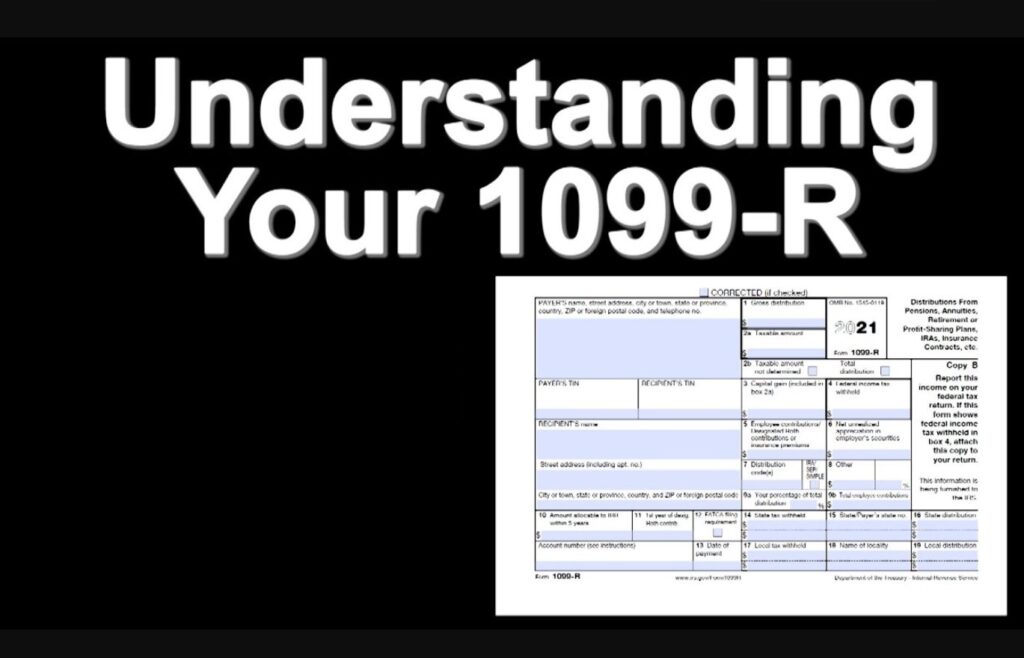

Key Components of Form 1099-R

Form 1099-R is relatively straightforward, but it has several important boxes that need careful attention:

- Box 1: Total distribution – This box reports the total amount of the distribution before any taxes are withheld.

- Box 2a: Taxable amount – This box shows the portion of the distribution that is taxable. In some cases, it may be equal to the total distribution, but sometimes it may be lower.

- Box 4: Federal income tax withheld – If any taxes were withheld from the distribution, they will be reported in this box.

- Box 7: Distribution codes – This box is critical, as it tells you the type of distribution and whether it is subject to penalties or exceptions.

Let’s dive deeper into Box 7 and distribution codes, as they’re often a point of confusion for many filers.

Understanding 1099-R Distribution Codes

The 1099-R Distribution Codes found in Box 7 of Form 1099-R describe the nature of the distribution and help determine how the distribution will be taxed. These codes are critical because they help you understand if the distribution is subject to early withdrawal penalties or if it qualifies for tax exemptions.

Some common 1099-R distribution codes include:

1) Code 1:. Early distribution, no known exception (under age 59½) – This code indicates that the distribution is subject to both income tax and an early withdrawal penalty.

2) Code 2:. Early distribution, exception applies – This code means that the distribution was taken early, but the individual qualifies for an exception (e.g., disability or medical expenses).

3) Code 3: Disability – This code applies to distributions taken by an individual who is permanently disabled.

4) Code G:. Direct rollover (tax-free). When funds are rolled over into another qualified retirement account, such as an IRA, this code is used to indicate that no taxes are due.

The distribution code you receive will directly influence how you should report the distribution on your taxes. Keep in mind that some codes also indicate whether you are required to pay an early withdrawal penalty, so understanding this is key to avoiding unnecessary penalties.

Decoding Box 7 Codes on Form 1099-R

As previously mentioned, Box 7 on Form 1099-R plays a pivotal role in determining how the IRS views your distribution. The IRS uses these codes to categorize the type of distribution, the reason for the withdrawal, and whether any penalties apply.

Here are a few more important Box 7 codes to keep in mind:

1) Code 4: Death – This code applies when a distribution is made due to the death of the account holder.

2) Code 7:. Normal distribution – This is used when the individual is 59½ or older and has made a standard distribution.

3) Code 8:. Excess contributions – This code is used when you’re withdrawing excess contributions from an IRA, and you may need to pay taxes on them.

When reviewing your Box 7 codes, ensure you understand which one applies to your situation, as it will determine your next steps in tax reporting.

How to Calculate the Taxable Amount on Form 1099-R

Determining the taxable amount on Form 1099-R requires reviewing the information presented on the form carefully. Box 2a shows the taxable amount, but it might not always be straightforward. Let’s look at the steps you should take to calculate the taxable amount:

- Review Box 1: Start by checking the total distribution reported in Box 1. This is the total amount you withdrew.

- Check Box 2a: This box shows the taxable portion of the distribution. If Box 2a is blank, you need to determine the taxable portion manually.

- Identify Contributions:. If you contributed after-tax money to the retirement account (e.g., Roth IRA), the taxable amount will be lower than the total distribution.

- Consider Other Factors:. If the distribution was rolled over into another qualified account or used for an exception (e.g., medical expenses or disability), these factors may reduce the taxable amount.

If the amount in Box 2a doesn’t seem to match your expectations, review the contribution history for your retirement account. You had non-deductible contributions, only the earnings from those contributions will be taxable.

What is the 1099-R Code G?

1099-R Code G indicates a direct rollover of retirement plan funds to another qualified account, such as an IRA or another 401(k). When this code appears on your Form 1099-R, it means that the distribution was tax-free, as the funds were directly transferred to another qualified retirement account. Since no money was actually withdrawn, there are no immediate tax implications.

However, it’s important to note that while you won’t owe taxes on a Code G rollover, the funds will still be taxed when withdrawn from the new account in the future. Therefore, even though you may not owe taxes now, you should still track the rollover to ensure proper reporting in future years.

Form 1099-R Instructions for Tax Filing

Once you’ve reviewed Form 1099-R and determined your taxable amounts, it’s time to move forward with the tax filing process. Here are the general Form 1099-R instructions:

- Transfer Information to Tax Forms: Transfer the information from 1099-R Form onto your tax return (typically on Form 1040). Make sure to report the taxable amount in Box 2a.

- Adjust for Taxable Amounts: If Box 2a is blank, calculate the taxable amount as explained earlier.

- Verify Tax Withholding: Ensure that any federal income tax withholding from Box 4 is applied to your total tax liability.

- Penalties for Early Distributions:. If applicable, pay attention to any penalties for early withdrawal, which may appear based on the distribution code in Box 7.

If you’re unsure of how to handle certain boxes or calculations, consider consulting a tax professional for guidance.

FAQs About Form 1099-R

What happens if I don’t receive a 1099-R form after taking a distribution?

If you don’t receive a 1099-R form after taking a distribution of $10 or more, it’s important to contact the financial institution or retirement plan provider. They are required to send you this form for tax reporting purposes. You can also request a copy if it was lost.

How do I report a 1099-R on my tax return?

You’ll report the taxable amount from Box 2a of your 1099-R on your tax return (Form 1040). If there were any federal income taxes withheld, make sure to report that information as well.

What is the penalty for early withdrawal of retirement funds?

If you withdraw funds before age 59½ without qualifying for an exception, you may incur a 10% penalty in addition to the income tax on the distribution. Certain exceptions, such as disability or medical expenses, may waive this penalty.

What does it mean if my 1099-R shows Code 7?

Code 7 on your 1099-R form indicates that you made a normal distribution. Meaning you were 59½ years or older at the time of withdrawal. These withdrawals are generally not subject to the early withdrawal penalty.

Do I have to pay taxes on a rollover reported on 1099-R?

No, if the distribution was rolled over into another qualified retirement account (indicated by Code G). You generally do not owe taxes on it at the time of the rollover. However, you will pay taxes when you withdraw the funds in the future.

Conclusion

Form 1099-R is an important document for anyone receiving retirement-related distributions, and understanding how to interpret and file it correctly is crucial for accurate tax reporting. From distribution codes to taxable amounts, navigating 1099-R Form can be challenging, but with this guide, you are now well-equipped to handle the complexities of this form.