State Sale Tax may be one of the most misunderstood concepts by many, especially when doing business in a state as dynamic as New York. For businesses and consumers, it‘s vital to know how sales tax works so that there are no surprises during the transaction process. At Syed Professional Services, we help companies understand New York City and New York State’s intricate system of tax laws, especially sales tax. We‘ll break down some of the fundamentals of sales tax, from how it works to how you can calculate it in New York.

What is Sales Tax?

A sales tax is a consumption tax that is levied on the sale of goods and services. The customer pays it at the point of sale, and the seller should collect and remit this amount to the government. It is usually computed as a percentage of the value of the goods or services purchased.

How Much is Sales Tax in New York?

The sales tax rate in New York can further be broken down into two categories: at the state level and local level.

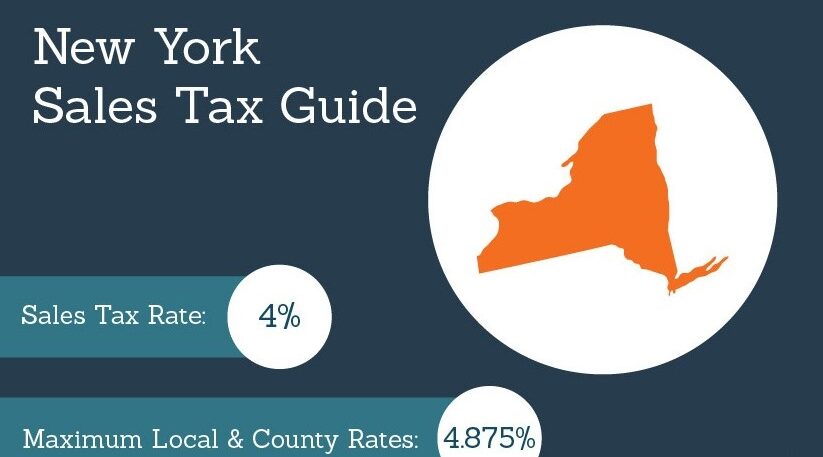

New York State Sale Tax: NYS imposes a 4% sales tax rate on most goods and services sold within the state.

New York City Sales Tax: Additional taxes are applied if you are in the NYC environment. The city adds its own sales tax, making it 8.875%. This is the addition of 4 % NYS sales tax for the city’s share at 4.875%.

Observe that while New York has uniform state sale tax rates for all counties except NYC, sales tax rates differ across other counties for business settings outside of NYC.

How to Calculate the Sales Tax in New York

It is easy to calculate sales tax. All that is needed to do is multiply the price of the item by the correct percentage rate. For instance:

If you’re purchasing something that costs $100 and you are in New York City, the sales tax would add up as follows:

$100 x 8.875% (the rate in NYC) = 8.88 in sales tax.

So, for a final total, you‘d pay to purchase the item. You would pay:

$100 + 8.88 = $108.88.

For business, you want to make sure you’re collecting the proper sales tax rate based on the location as well as the nature of the product or services being sold.

How to Locate State Sales Tax Rates in New York

To ensure you are applying the correct sales tax rates, it’s crucial to:

Check Local Tax Rates: Within New York, the sales tax rate is not uniform across counties and cities. There exists a helpful online tool to assist businesses and consumers in determining a current sales tax rate based on their location from the New York State Department of Taxation and Finance.

Consult with Professionals:. Given the complexity of tax laws. Working with professionals like Syed Professional Services can help ensure that you’re applying the right tax rates and remaining compliant.

Why Understanding Sales Tax Matters

Whether it is a business or a consumer, knowing sales tax is crucial in financial planning. For businesses, misestimation of sales tax may sometimes lead to penalties or even cases in court. Consumers can budget by ensuring they’re not budgeting wrong when buying.

Tips for Businesses to Remain in Compliance

For businesses, especially New York businesses, it is essential to be aware of the following:

Register for Sales Tax Collection: When your business has sales of taxable products or services, you are required to register with the New York State Department of Taxation and Finance.

Keep Detailed Records: Maintain correct records of all your transactions so that you can easily file returns of sales tax.

File sales tax returns on time. The frequency by which you need to file sales tax returns depends on your business sales volume. You may file monthly, quarterly, or yearly.

Engage a tax professional. Tax laws change constantly. By working with a tax professional such as Syed Professional Services. Your business will be up-to-date with all the tax regulations.

Conclusion

In New York, whether running a business or making a purchase, it’s very important to understand how sales tax works because rates vary depending on the location, whether it’s NYC or other parts of New York State, and so it’s necessary to know the right tax rate to use. Syed Professional Services stands committed to helping businesses navigate this sometimes-confusing tax law and ensuring that the business complies with them to avoid any risk of mistakes.

If you’re unsure about how to calculate sales tax or need help with your tax filings. Don’t hesitate to reach out to us. Our experienced team is here to assist you every step of the way.

Contact Us Today

If you have any questions about sales tax or need assistance with tax planning. Syed Professional Services is here to help. Contact us for expert guidance in navigating New York’s tax system!